Covid-19 Live Blog

1 June 2020

Hiscox Action Group member says FCA update ‘reinforces’ decision to opt for arbitration lawsuit

The FCA gave an update today on the timeline it expects to meet for its business interruption test case.

It also highlighted 16 insurers that will participate in the High Court procedure to represent 17 policy wordings the regulator believes will bring the most amount of clarity to the market.

But Hiscox Action Group (HAG) co-founder Daniel C Duckett believes the process could go on for months if the decisions in the test case are appealed, reinforcing its choice to seek redress through an expedited arbitration claim.

Speaking to NS Insurance, he said: “This doesn’t affect our plans at all. In fact it reinforces our decision based on their extremely lengthy timeline.

“With a hopeful court date in late July that could last at least two weeks, that would push an initial decision into August,” he said.

“This doesn’t take into account the appeals process, which would again push a final decision back months or potentially years.

“The HAG firmly believe the insurance industry will push back until all avenues are exhausted in an effort to dissuade claims.

“We are instructing our members that the Financial Ombudsman Service route will be stayed pending that outcome, so complaints may not be heard for quite some time.”

1 June 2020

GlobalData epidemiologist report: Global Covid-19 confirmed cases passes 6m | Latin America continues to spread as US, Asia and Europe peak

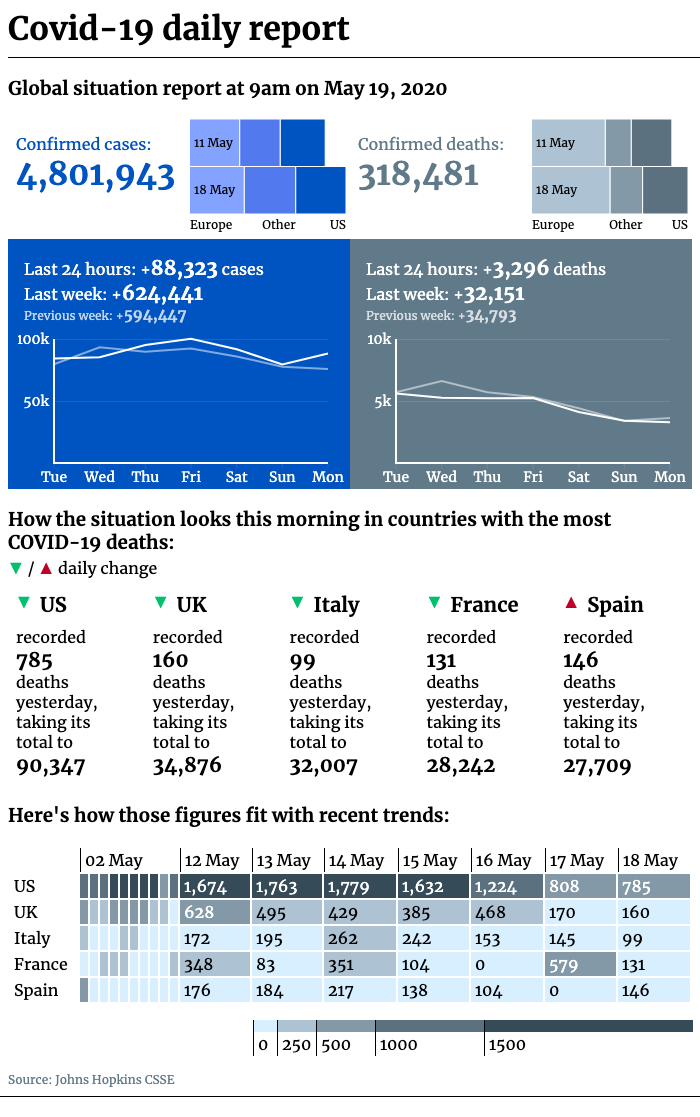

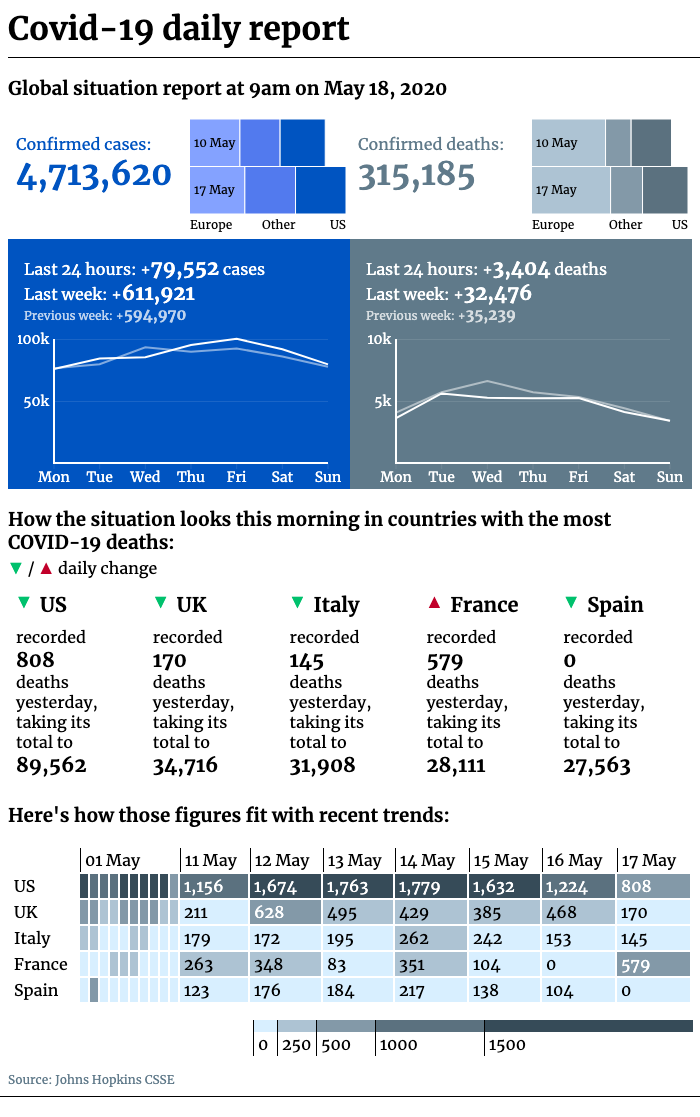

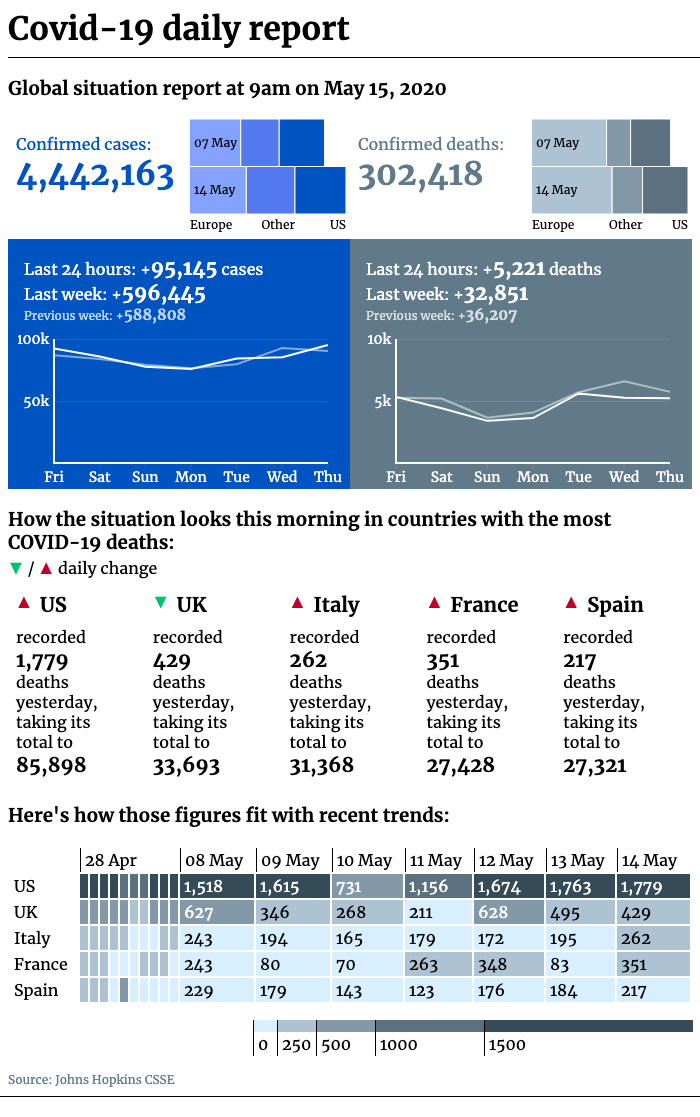

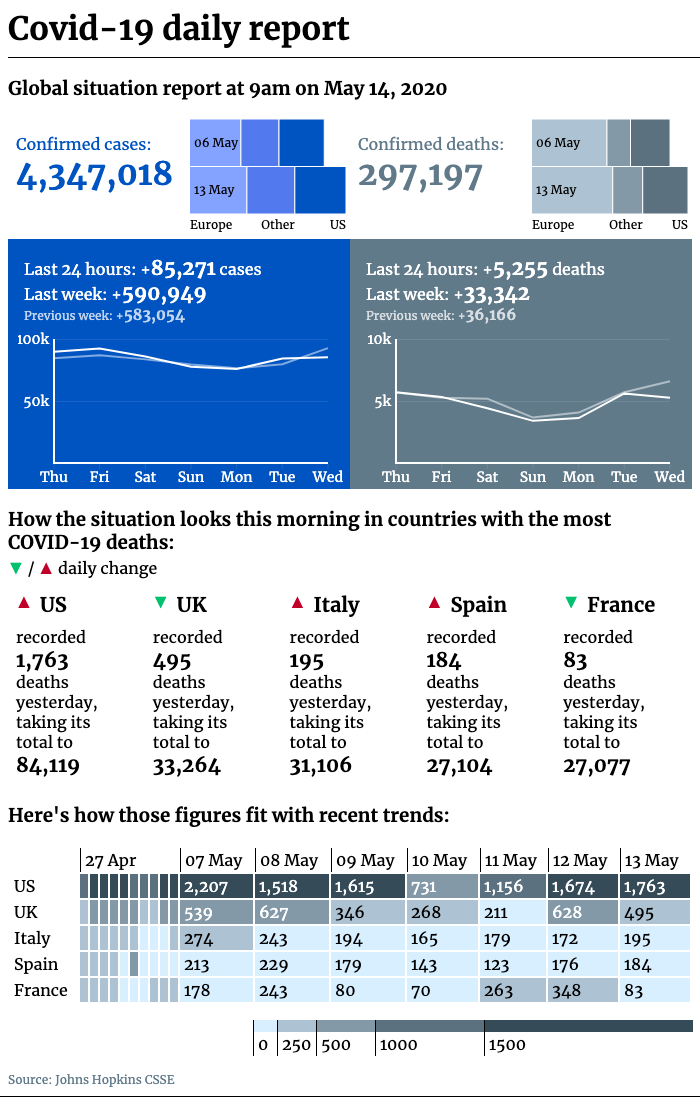

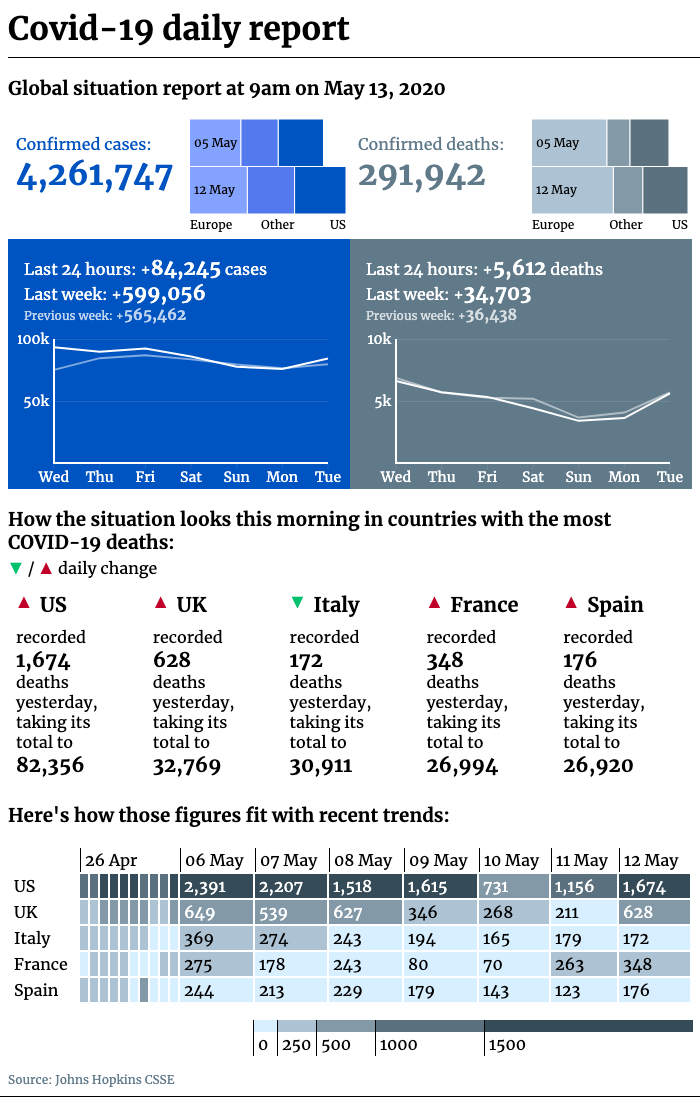

Globally, the total confirmed cases of Covid-19 have reached more than 6,185,000, with over 372,000 deaths and 2,648,000 recoveries.

In Europe, Asia, and the US, coronavirus has likely peaked as recoveries rise and the number of new infections decline.

In Latin America the pandemic continues to spread. Brazil is now the fourth highest country in the world by death count. As the largest country in South America, it remains an area of major concern as cases continue to rise, and the availability of testing and treatment remains limited.

In the US, protests swept the nation over the weekend, leading to mass gatherings nationwide – creating potential hotspots for disease spread.

Despite the positive trends seen in moving past the peak of the pandemic, the risk of a second wave remains high.

Qatar currently has the highest incidence rate of disease in the world at nearly 2,000 cases per 100,000 population and is one of the hardest-hit regions in the Middle East.

Topias Lemetyinen, MPH, managing epidemiologist at GlobalData

1 June 2020

Covid-19 insurance daily update: FCA selects 17 policy wordings for scrutiny in BI test case for July – while RSA reaffirms expected £25m claims impact from pandemic

The FCA has selected 17 policy wordings for its test case to be brought to the High Court in July. The regulator believes the representative samples picked will give the best chance of providing clarity to the market on the wide range of disputed business interruption policies held in the UK. Given the nature of the case, the FCA said the list is not exhaustive and urged all insurers to check their policy wordings against those it intends to test, to see if theirs will be impacted by the outcome of the case. After collecting this information, it said it intends to publish a list of all the relevant insurers and policies that may have impacted wordings in early July.

British insurer RSA has said it doesn’t expect to alter its Q1 estimate of losses incurred due to claims related to Covid-19, despite being a part of the FCA test case for business interruption insurance disputes. The insurer said in its first-quarter trading update this year it expects to take losses of £25m net of reinsurance, stretching across policies for travel, wedding cancellation and commercial lines business interruption. In a statement today, it addressed its inclusion in the FCA test case in relation to its estimated losses. “Market share has not been a determining factor in selection, and RSA’s inclusion is not representative of its market share on the relevant policy wordings,” it said.

29 May 2020

Insurers paying high amounts in Covid-19 claims will be less resilient to pandemics, says analyst

Insurers set for high Covid-19 based payouts will be hit harder by catastrophe claims towards the end of the calendar year.

This is according to GlobalData senior insurance analyst Daniel Pearce, who said the recessionary impact of the pandemic will have a range of impacts on insurers’ balance sheets that make them less resilient to catastrophes.

“The combination of natural catastrophes, volatility in financial markets and economic recession will put the insurance industry under considerable strain.

According to Pearce, the full impact will not be known until later in 2020 – once the majority of natural catastrophes pass and the severity of the economic implications become clearer.

But he said it’s not just claims, but also the affect on investments held by insurers that could have an impact on finances.

“Insurers’ exposure to financial markets through the investments they hold has been negatively impacted, as financial markets globally have fallen to unprecedented levels,” he added.

“Combining this with record-low interest rates, which have been set to provide some relief to economies anticipating recession, means the pressure on insurers’ balance sheets has increased dramatically.

“The economic impact will not only be felt through financial market volatility but also the potential downturn in the demand for commercial insurance as economies slide into recession and businesses are forced to close.

“With the hurricane and typhoon season yet to arrive for 2020, the insurance industry is braced for a turbulent future.”

29 May 2020

Thailand life insurance industry to decline in 2020, but future growth expected by analysts

Thailand’s life insurance industry, which has witnessed decelerating growth rates since 2015, will decline in 2020 owing to the prevailing challenges aggravated by the macroeconomic impact of Covid-19.

This is according to GlobalData insurance analyst Madhuri Pingali, who included the cost of technical and practical changes required to meet the new reporting standard set out by IFRS 17 in a list of challenges faced by insurers in Thailand.

“Life insurers in Thailand have been under pressure due to systemic challenges such as low awareness, aging population, declining GDP growth rate and prolonged low-interest environment,” she said.

“Downward revision in insurance prices due to the introduction of new mortality rates and the new regulatory framework, especially the implementation of IFRS 17 and 9, are set to further exacerbate the problems.”

GlobalData estimates that life insurance premiums will decline for the second consecutive year by 1.6% in 2020.

But the industry is expected to recover from 2021 and is forecast to grow at a compound annual growth rate (CAGR) of 2.1% from 2019 and 2024.

Pingali referenced the recent increase in the sale of Covid-19 related life insurance products to suggest the roots of this recovery is already being seen in Thailand.

“The projected GDP contraction in 2020 due to the Covid-19 outbreak is expected to reduce personal savings, leading to a decline in the life insurance business in 2020,” added Pingali.

“The spike in the sale of Covid-19 insurance products in the last couple of months indicates that despite the immediate setback, the industry stands to benefit in the long-term due to increase in consumer awareness following the outbreak.”

29 May 2020

Covid-19 insurance daily update: Fraudulent broker arrested for selling unregulated car insurance to NHS workers | Former White House health policy advisor says Covid-19 will be a test of ACA safety net

A man was arrested yesterday by the City of London Police for allegedly acting as a ‘ghost broker’, selling fraudulent car insurance, and recently offering the same to NHS workers at a discount. On Wednesday 27 May 2020, officers from the City of London Police’s Insurance Fraud Enforcement Department (IFED) executed a search warrant at an address in Luton and arrested a man, 25, on suspicion of Fraud by False Representation. The man is suspected of advertising fraudulent car insurance services unregulated by the Financial Conduct Authority via social media.

An article on the website of the Journal of the American Medical Association from the Kaiser Family Foundation’s Larry Levitt suggests that job losses caused by the pandemic will test how effective the Affordable Care Act is as a safety net. The firm’s executive vice president for special initiatives served as senior health policy advisor to the White House and Department of Health and Human Services between 1993 and 1995. He wrote: “The current economic crisis could be the ACA’s test of how well it can catch people who fall out of the employer health insurance system. The ACA has the potential to cover a large share of people who lose job-based health insurance, but this crisis may also expose weaknesses in the law’s design, how it has been implemented, and how it has been weakened by the Trump administration.”

28 May 2020

Government fast-tracking e-scooters onto UK roads could create opportunity for insurers

The UK government plans to quicken the pace of introducing electric scooters onto roads, and GlobalData insurance analyst Jazmin Chong believes this could create both challenges and opportunities for insurers.

“Due to the rapid launch of e-scooter trials, and fears of overcrowding on public transport in the midst of the Covid-19 pandemic, the popularity of e-scooters could soar.

“However, the UK Government might not have the appropriate time to pass the much-needed regulation insurers require to cover these vehicles.

“This would leave a market opportunity for UK insurers that can deliver pay-as-you-go insurance services and overcome legal barriers in a time of crisis.”

The government wants to make e-scooter rentals available to the public in the same way they are in countries like Belgium and France, in order to give people an alternative to public transport, which they want travellers to avoid.

London-based insurer Zego has signalled a desire to insure new mobility vehicles in the past, and currently providers coverage for the fleet of Amsterdam-based Dott.

As of yet though, the insurtech hasn’t been able to insure fleets of e-scooters in the UK simply because they’re not legal to ride outside of private land.

28 May 2020

Why are insurers facing legal challenges over their business interruption policies?

The insurance industry has been rocked by accusations it hasn’t honoured contractual obligations to pay out on business interruption (BI) claims, and is leaving businesses without a lifeline when they need it most.

In a recent case, a ruling in the state of New York favoured Sentinel Insurance Co in its dispute with luxury publication Social Life Magazine through a decision that Covid-19 can’t cause property damage, and so the publication’s property-based business interruption cover was unlikely to trigger.

But while BI coverage was never created to respond to a pandemic, the wording in policies that do extend to non-damage risks like virus and disease is leaving them open to legal challenges, some of which will be funded by third parties betting on a victory for the claimants and a return on their investment.

Two examples are the Hiscox Action Group (HAG) and Hospitality Insurance Group Action (HIGA) – both of which expect to bring lawsuits against their respective insurers soon.

The HAG will do this with backing from Harbour Litigation Funding, while HIGA and its legal representative Mishcon De Reya, which is also representing the HAG, are still in talks with third party funders.

We’ve put together this explainer to help understand the type of wording that’s vulnerable to legal action.

28 May 2020

Cyber and fleet coverage two of the few avenues for growth in insurance, says analyst

As UK businesses have adapted to the Covid-19 lockdown situation by selling more products online, the opportunity to address their increased cyber risk with insurance has also grown.

This is according to GlobalData insurance analyst Yasha Kuruvilla, who believes cyber coverage is one area that could see growth as the industry expects to struggle in others.

“Retailers will hold more digital records of sensitive personal information, including payment details, than ever,” he said.

He also cited a report from Shape Security, which found hackers account for more than 90% of login attempts on e-commerce websites, as evidence of the risk online sellers face.

For firms operating delivery services, he expects the number of vehicles in fleets to grow too, presenting another area for potential insurance growth.

“This may not translate into new policies for large retailers that are more likely to already have cyber and fleet insurance products in place.

“However, some SMEs have explored the online channel in order to generate some sales during the lockdown.

“With online sales increasing in popularity, it is likely that some of these will make online sales a lasting feature, opening the door for new insurance policies to be sold.”

28 May 2020

Almost half of UK SME owners fear their business is at risk of permanent closure, says survey

Nearly half of all small and medium sized enterprise owners in the UK fear their business is under threat of closure due to the impact on trading caused by Covid-19 and the country’s lockdown measures.

This is according to a new survey from insurer Simply Business, which found 41% of owners were concerned the pandemic would force them to close, and 4% responding that they’d already folded – a figure Simply Business suggested represents 234,000 SMEs when the results are generalised to the UK’s 5.8 million SMEs.

In financial terms, the survey calculated the total impact of Covid-19 will exceed £69bn ($84.5bn), a figure extrapolated from respondents’ estimates that the pandemic will cost them £11,779 each on average.

Simply Business UK CEO Alan Thomas said: “No business has been able to escape the impact of the pandemic – and that’s no different for small businesses and the self-employed.

“Yet they are the lifeblood of the economy, and with many of these at risk of permanent closure, so much is at stake for our local communities and wider economy.”

Simply Business surveyed 3,700 SMEs across the UK for its SME Confidence Report.

28 May 2020

Covid-19 insurance daily update: New York’s Times Square goes dark in support of businesses with unpaid interruption claims | Tower Insurance to cut 108 jobs as business goes digital

New York’s Times Square is famed for its bright lights created by streets full of billboards, but the lights went out for one minute at 9pm last night (27 May) in support of businesses fighting to claim insurance money. The action was organised by the Business Interruption Group (BIG) – a collection of restauranteurs that banded together with lawyer John Houghtaling of legal firm Gauthier Murphy & Houghtaling. It was supported by Times Square Alliance and the NYC Hospitality Alliance to raise awareness about denied business interruption claims. “This is to symbolically show that the insurers are turning the lights out on businesses,” said Houghtaling.

New Zealand firm Tower Insurance is making 108 of its staff redundant, a move it says was made to capitalise on the trend of customers buying digitally rather than through an agent. “People want to do more digitally and are choosing to become Tower customers because of this,” CEO Richard Harding said in a statement to 1 News. He continued: “In March almost 60% of our new business came in through our digital channels and with our new self-service portal, have had over 40% of claims lodged online in March. The growth we are achieving through digital channels and the number of customers now choosing to interact with us online shows that digital is the way of the future. Our strategy has always been to grow our business from our existing cost base, however, the current recessionary environment means that future growth will now be lower than we had planned for, and to offset that, we need to reduce our costs.”

The US Travel Association has lent its support to a new bill introduced by congresswoman Carolyn B Maloney on Tuesday (26 May) that seeks to establish a Pandemic Risk Insurance Act akin to the government-backstopped insurance programme the country has to respond to terrorist attacks. The association’s vice president for public affairs and policy Tori Emerson Barnes said: “9/11 exposed the need for terrorism risk insurance, and since the impact of coronavirus on the travel industry has been nine times that of 9/11, it is very sensible to offer a similar backstop for pandemics. This measure will go a long way in giving businesses the confidence they need to reopen, which will be vital to a rapid, robust and sustained economic recovery.” The US Travel Association joins the National Retail Federation, American Society of Association Executives and Nonprofit New York, among others, in support of the bill.

27 May 2020

Illinois to get business interruption insurance taskforce if new bill gets approved

An amendment made by Illinois representative Kelly M. Burke has proposed the creation of a task force in her state to study the impacts of the Covid-19 pandemic on businesses, and the potential need for changes to interruption cover.

The proposal was made on 21 May through an amendment to the Government Emergency Administration Bill, and stated that the task force shall include a representative based in Illinois from a national trade association that represents insurers who hold a significant amount of commercial insurance market share.

The task force would have no more than 10 members appointed from the Illinois Department of Insurance as well as the wider industry, and would report its findings and recommendations for legislation to the state Governor and the General Assembly by December 31, 2020, and be dissolved on the same date in 2021.

The bill and its amendment were approved by both houses of the Illinois General Assembly on 23 May and await final sign off from state Governor JB Pritzker.

27 May 2020

New York court rules in favour of insurer, agrees Covid-19 didn’t cause physical damage

A legal case fought in the US over business interruption insurance claims during the Covid-19 pandemic has turned out favourably for the insurer, according to a law firm.

Carlton Fields insurance coverage attorney Andrew Daechsel highlighted a decision made by the US District Court for the Southern District of New York at a 14 May hearing.

In Social Life Magazine Inc v Sentinel Insurance Co, a magazine publisher had sought a preliminary injunction – an expedited ruling that would require the defendant-insurer to pay the company’s business interruption claim if the case was resolved in the plaintiff’s favour.

But the presiding judge Valerie Caproni denied the publisher’s argument that the coronavirus had caused “on-site property damage,” on the basis “it damages lungs – it doesn’t damage printing presses.”

According to Daechsel, the plaintiff’s counsel argued Covid-19 could cause property damage because “the virus, when it lands on something and you touch it, you could die from it”.

Judge Caproni responded: “That damages you. It doesn’t damage the property.

“You get an ‘A’ for effort, you get a gold star for creativity, but this is just not what’s covered under these insurance policies.”

27 May 2020

ABI’s Huw Evans refutes claims that insurers have failed customers affected by Covid-19

Association of British Insurers director general Huw Evans has hit back over claims that insurers are failing customers financially hit by Covid-19.

“Far from failing our customers”, he said insurers in the UK expect to pay at least £1.7 billion in claims as a result of Covid-19, including over £900m to businesses and £275m to people claiming on travel insurance.

His comments came in response to an open letter written by Covid Claims Group founder James Ollerenshaw, supported by more than 700 businesses, which claimed insurers had “abrogated responsibility” through denying to pay out on policies with extended coverage for interruption caused by non-physical damage.

In his response letter, Evans said: “With regard to SME purchase of non-damage business interruption extensions, I can assure you that each claim is being examined on a case by case basis by ABI members.

“Where the policy wording allows for a claim to be paid, it will be – hence the £900m our members expect to pay swiftly and with interim payments wherever possible.

“This will be on top of the average of £7.8 billion paid by insurers each year to SMEs and larger businesses for day to day risks such as fire, flooding and employee accidents.”

27 May 2020

Reinsurers will struggle to earn their cost of capital in 2020, says Fitch

Credit assessor Fitch Ratings says the global reinsurance sector will not earn its cost of capital in 2020.

The measure is used to assess the return a reinsurer needs to accumulate in order to pay both its debt interest and provide returns to shareholders.

According to Fitch, the financial performance of reinsurers will be hit by mortality claims and losses from event cancellation, business interruption, credit and surety insurance, as well as by financial market disruption linked to the economic impact of lockdown measures.

After conducting a sector ratings review and coming to the conclusions above, Fitch downgraded the financial strength rating of industry giant Swiss Re from AA- to A+, and Mexican reinsurer Reaseguradora Patria from A- to BBB+, with the new ratings assessed as stable for both.

In its report, Fitch’s analysts said: “The main driver for the negative rating actions was deteriorating financial performance.

“Based on our pro-forma analysis, we continue to view the global reinsurance sector’s capitalisation as strong on average, with pro-forma capital ratios not much weaker than those at end-2019.

“We expect capitalisation to hold up in most cases and not be a major driver of rating actions.”

27 May 2020

Covid-19 daily insurance update: New York representative introduces pandemic backstop bill to congress | AXA to cover two months of restaurant’s lost income after losing court case

New York representative Carolyn B. Maloney has introduced the Pandemic Risk Insurance Act (PRIA) bill to congress. The legislation proposes a government backstop to reimburse insurers for 95% of their claims costs where they’re linked to a pandemic. According to reports, more than 24 US business organisations, including the International Franchise Association and the International Council of Shopping Centers, have endorsed the bill. Maloney also has support from the Council of Insurance Agents and Brokers and insurance firm Marsh & McLennan. the National Association of Mutual Insurance Companies (NAMIC), the American Property Casualty Insurance Association (APCIA), and Independent Insurance Agents and Brokers of America, have opposed the bill. Instead they’re attempting to raise the profile of their own plan, which would see the government take on 100% of the risk and pay out through the existing infrastructure within the Federal Emergency Management Agency (FEMA). Maloney is currently seeking a Republican co-sponsor to increase the chance of bipartisan support for the bill in congress.

French insurance giant AXA has been forced to pay two months of lost income to Paris restaurant owner Stéphane Manigold to cover the interruption to his four eateries caused by Covid-19. The insurer lost its case fought to uphold the denial of a payout to Manigold last week, and AXA has since said it will appeal the decision. Despite this, CEO Thomas Buberl signalled a desire to engage with policyholders with similar coverage and avoid further court battles. He said: “These contracts represent less than 10% out of total contracts with restaurant owners and I am confident that we will find a solution. We want to compensate a substantial part of these contracts, we want to do it quickly.” With ongoing legal battles in the UK and US between hospitality businesses and their insurers, it’s likely the outcome of AXA’s appeal will be watched closely by those hoping the decision will be upheld and set a precedent that will cross borders.

27 May 2020

GlobalData epidemiologist report: US nears 100,000 Covid-19 deaths | Brazil could overtake as worst-hit country

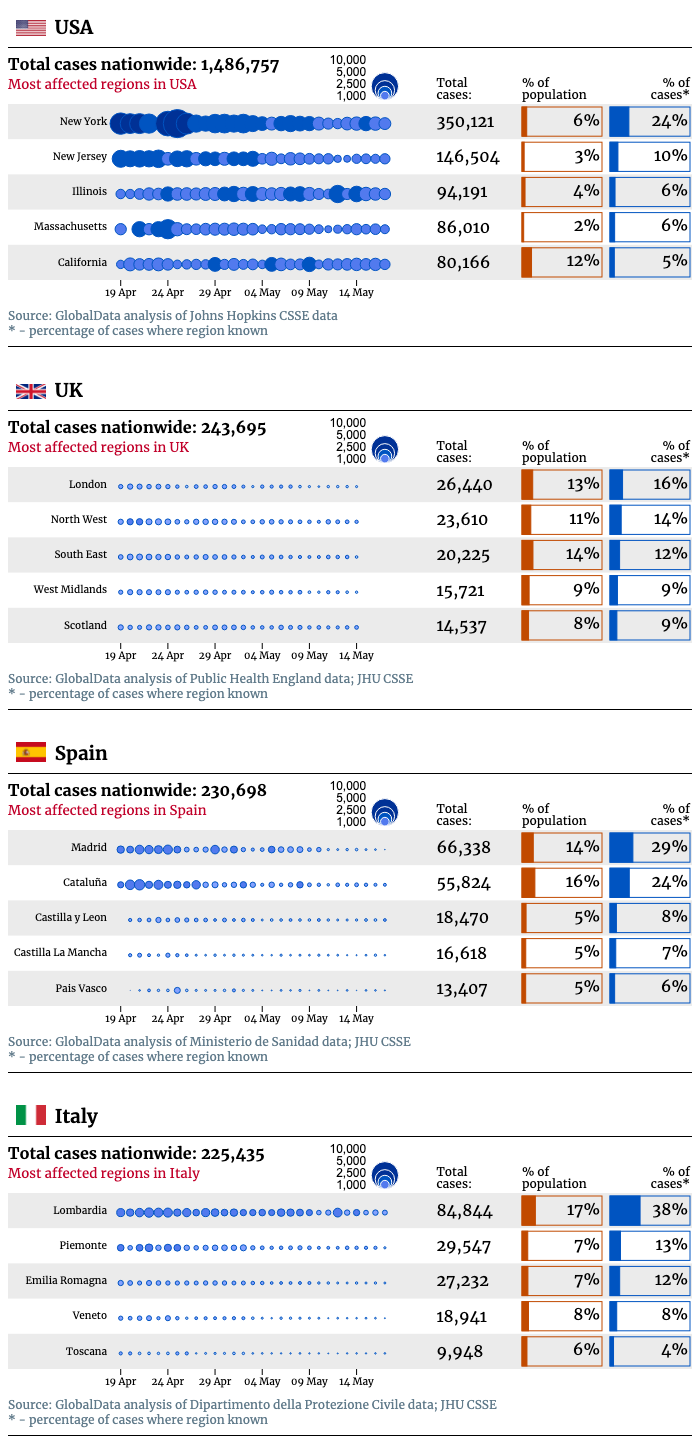

Globally, the total confirmed cases of Covid-19 have reached more than 5,518,000 with over 346,700 deaths and 2,232,000 recoveries.

In the US, there are over 1,662,000 cases and over 98,000 deaths. However, Covid-19 deaths in the US are on the decline.

Brazil’s daily incidence is reported to be second only to the US and may become number one globally if the increasing incidence trend continues.

Daily incidence rates also continue to rise in Peru and Chile, making these three South American countries in the top six countries in terms of daily incidence rates.

In Japan, the state of emergency has lifted and marks the official end of the restrictions.

The prime minister ended the state of emergency after a month and a half. Japan currently has more than 16,500 cases and over 800 deaths.

Nanthida Nanthavong, MPH, epidemiologist at GlobalData

26 May 2020

Federation of European Risk Management calls on EU to address gap in business interruption catastrophe risk

The Federation of European Risk Management (FERMA) has called on the EU to create a resilience framework for addressing uninsurable catastrophes like the current pandemic.

The primary concern the organisation is looking to address through its proposal is the gap in business coverage caused by exclusions for non-damage interruption.

The resilience framework proposed by FERMA would function on four levels:

Enterprise-level risk management: anticipation, prevention, identification and mitigation of risks

Transfer of risk to private insurance and reinsurance markets, developing enhanced coverage for NDBI (non-damage business interruption)

National Member state pool guarantees

European Union support for, and coordination between national governments

FERMA president Dirk Wegener said: “This holistic approach supported by the insurance sector, national governments and EU institutions would ensure that the resilience framework has the capacity to benefit all businesses, from small and medium-sized enterprises facing immediate liquidity issues, to the largest transnational corporations concerned with supply chain and trade disruptions.

“We now aim to deepen discussions with the EU, the Member States and the insurance sector, and to develop solutions for both short-term crisis management and long-term business resilience.

“FERMA members have expertise and experience in the field of business interruption that we want to contribute to the future resilience of European business.”

26 May 2020

Fitch Ratings says business interruption lawsuits could impact credit ratings

Global credit assessor Fitch Ratings says court rulings on business interruption disputes could impact the credit quality of insurers in the UK non-life sector.

The firm said claimants may win in certain court actions if the relevant policy wording is “loose” – something those seeking to push lawsuits are betting on – exposing companies to unexpected losses.

It issued the updated guidance on ratings after conducting a stress test, in which the main stressor was the impact of potential liability exposure, particularly in relation to event cancellation and business interruption claims.

Fitch previously put both Beazley and Hiscox on Rating Watch Negative (RWN) – meaning they could potentially have their ratings downgraded – but both have since raised equity by releasing additional shares, and had their ratings affirmed as stable in response.

Fitch’s report said: “Subsequent to the initial rating actions, Hiscox and Beazley raised new capital of 20% and 15%, respectively, through the issuance of new ordinary shares.

“As a result, we revised the Outlooks back to Stable. Hiscox and Beazley remain exposed to potential coronavirus-related underwriting losses.

“In our view, both Hiscox and Beazley now have sufficient capital buffers to withstand a potential increase in pandemic-related claims”

Fitch added in its commentary on the report that it expects both business interruption and event cancellation claims caused by Covid-19 to impact underwriting in 2020, but will peak in 2021, especially where legal action is required.

26 May 2020

NFU Mutual gives car and small van customers free RAC home breakdown cover

NFU mutual has given its UK car and small van insurance customers free national recovery and home breakdown coverage in response to a 78% rise in home starts recorded by the RAC.

Customers will have temporary access to cover for breakdowns that occur at, or within, a quarter of a mile from their home, as well as the recovery of the vehicle, driver and passengers if it can’t be repaired at the roadside.

NFU Mutual also temporarily extended the RAC coverage of small vans to include emergency roadside assistance and recovery of the vehicle, driver and passengers.

“During these challenging times, many of our private car customers haven’t been using their vehicles as frequently, and flat battery starts are expected to rise over the next few months.

“We want to ensure our customers aren’t disadvantaged for acting responsibly by staying at home and driving less, which is why we are giving them home and national recovery cover at no extra cost, in addition to the Mutual Assist RAC cover they already receive as standard.

“For our customers who live in remote areas of the countryside without access to a nearby garage, this could be a lifeline.”

The move comes after RAC data revealed a 78% increase in home starts between 23 March and 11 May.

The coverage extensions will be available to both existing customers and those who buy private car or van insurance before August 31, when the temporary benefits are removed.

26 May 2020

Admiral urges drivers to remain vigilant as it sees collisions with parked cars increase

Welsh insurer Admiral has reported an increase in the number of insurance claims caused by drivers crashing into parked cars since the UK lockdown began.

The Cardiff-based firm said 29% of the claims it received since 23 March, the date the government made it mandatory for all but key workers to stay at home, have been related to a driver hitting an unattended car.

In the six weeks prior to this date, it recorded a figure of 19% for this type of claim, and Admiral said the increase has made it the most likely accident to be reported by its customers.

Admiral head of claims Lorna Connelly said: “Regardless of how many cars are on the roads, it’s important that drivers remain vigilant at all times and stay alert to their surroundings while behind the wheel.

“If you do hit another vehicle or wildlife, it’s important to contact your insurer as soon as it’s safe to do so.”

Admiral did see other types of claims decrease, and appears to still expect a general decrease in the number of claims recorded during lockdown.

26 May 2020

Morning briefing: Shops to reopen in England | WHO stops testing Trump-backed drug for Covid-19

Good morning. Here is the latest Covid-19 news from around the world.

Global: There are almost 5.5 million Covid-19 cases worldwide, according to the Johns Hopkins University coronavirus tracker, which has counted a total of 5,495,061 confirmed infections. The death toll stands at 346,232.

Countries where coronavirus infections are declining could still face an “immediate second peak” if they let up too soon on measures to halt the outbreak, the World Health Organisation (WHO) said.

The WHO has suspended testing the malaria drug hydroxychloroquine in Covid-19 patients due to safety concerns.

UK: England’s outdoor markets and car showrooms can reopen from 1 June, as soon as they can meet guidelines to protect shoppers and workers, Prime Minister Boris Johnson said as he urged the public to spend money in stores when the curbs are lifted.

US: The White House brings forward Brazil travel restrictions by two days, amending the timing to 11.59pm ET on Tuesday, 26 May.

The Trump administration said sufficient quantities of Abbott Laboratories’ ID NOW Covid-19 test and Quidel Corp’s Sofia 2 instruments exist to support 200 million US tests per month.

Latam Airlines Group SA, Latin America’s largest air carrier, sought bankruptcy court protection in New York after the Covid-19 pandemic grounded flights across the region.

Indonesia: Indonesia deployed hundreds of thousands of army and police personnel across the vast archipelago to enforce social-distancing rules, after a record surge in infections in the past week cast doubt on plans to reopen Southeast Asia’s largest economy.

Australia: Australia will not open the country’s borders “anytime soon”, Prime Minister Scott Morrison said, but added the country will continue its discussions with neighbouring New Zealand for a trans-Tasman safe travel zone.

Saudi Arabia: Saudi Arabia will revise curfew times this week, and lift it entirely across the Kingdom with the exception of the holy city of Mecca starting 21 June, state news agency reported in a statement early on Tuesday.

Germany: Germany threw Lufthansa a €9bn (US$9.8bn) lifeline on Monday, agreeing a bailout which gives Berlin a veto in the event of a hostile bid for the airline.

Iceland: Iceland eased its national alert against the coronavirus on Monday, allowing for public gatherings of up to 200 people and night clubs and gyms to reopen as the country nears complete recovery from the outbreak.

Hong Kong: Hong Kong International Airport will open for some transit services from 1 June, chief executive Carrie Lam said on Tuesday.

China: China reported seven additional coronavirus cases by the end of 25 May, with all of them from abroad, according to a statement from the National Health Commission. Of the seven cases, five were reported in Inner Mongolia.

26 May 2020

Covid-19 insurance daily update: Irish insurer FBD under fire over business interruption claims – while pressure mounts on Australian motor firms to give rebates

Republic of Ireland firm FBD Insurance will be part of a court case to be heard in October after several businesses disputed their claim for business interruption caused by Covid-19. According to The Journal, they all dispute FBD’s refusal to indemnify them, as well as its stance that the policy of insurance does not cover the Covid-19 pandemic. One firm claimed to be losing €30,000 per week since it was forced to close, with another claiming to be losing €56,000. Three firms will be featured in test actions in October, meaning the results of each case will set a precedent for similar cases.

Motor insurance firms in Australia are facing growing pressure to give customers a rebate on their insurance while they’re driving less. According to data from Apple, the number of driver requests on its Maps app dropped by 73% below normal levels during the peak of lockdown in mid-April. Consumer Action Law Centre insurance policy officer Tom Abourizko told The New Daily: “With fewer cars on the road due to Covid-19 restrictions, it’s likely car insurers will get a significant windfall due to fewer car accidents. Insurers generally require consumers to notify them of any relevant change in circumstances, and if that change increases the risk of a claim, it normally results in an increase in premiums.” Seven insurers in the country have taken action to give premium relief to customers using a range of methods.

Reports suggest New York representative Carolyn B. Maloney will hold a press conference this week to introduce a bill that, if approved by congress, would put in place a government backstop for 95% of claims caused by future pandemics. Insurance industry groups the National Association of Mutual Insurance Companies (NAMIC), the American Property Casualty Insurance Association (APCIA), and Independent Insurance Agents and Brokers of America, are disputing the bill. Instead they’re attempting to raise the profile of their own plan, which would see the government take on 100% of the risk and pay out through the existing infrastructure within the Federal Emergency Management Agency (FEMA).

22 May 2020

Celebrity lawyer Mr Loophole calls on government to make cycling insurance mandatory

Motoring lawyer Nick Freeman has called on the UK government to make it mandatory for cyclists to have insurance in place if they are to use their bikes on the road.

The legal professional, who is better known as Mr Loophole for his propensity to help celebrities dodge speeding charges using technicalities, made the comments on TalkRadio alongside suggestions that cyclists be made more identifiable to bring them under the same level of scrutiny as other road users.

“Lack of cars has allowed a culture of toxic cycling to prevail on our empty roads as some riders claim the highways as their own,” he said.

“It has made some cyclists ride with a sense of dangerous entitlement.”

The Covid-19 lockdown has led to a boost in cycling and the buying of bicycles, with many, including the PM Boris Johnson, expecting the activity to continue among the population once the measures are lifted.

If that prediction comes true, both cyclists and drivers will have to coexist safely on the road, and Freeman believes insurance must be part of the plan to ensure that.

He told TalkRadio he is lobbying for changes that would require cyclists to have insurance and be punished for breaking road laws with penalty points.

22 May 2020

Aviva expects £160m impact on claims due to Covid-19, with limited BI exposure

British giant Aviva said in a Q1 trading update that it expects take a £160m hit from claims related to Covid-19.

The firm estimates it will receive business interruption claims amounting to £200m, but that its exposure to paying out will be limited because most policies won’t include cover for Covid-19.

This is despite the fact that it is one of two insurers facing legal action from Hospitality Insurance Group Action – a conglomerate of businesses looking to get financial redress for their denied claims through the court system.

Aviva CEO Maurice Tulloch said: “Aviva had a solid first quarter of trading. General Insurance sales increased 3% and we had a strong performance in Life Insurance where new business increased 28%.

“Based on analysis as at 30 April, our estimate of the Covid-19 claims impact on general insurance, incorporating notified and projected claims, is £160m net of reinsurance.

“At 31 March, our estimated solvency ratio remains strong at 182% and incorporates Covid-19 related impacts.

“The economic outlook remains uncertain and will affect our business, however the strength of our capital and liquidity means we are well positioned to manage this crisis and continue to support our customers.”

22 May 2020

GlobalData epidemiologist report: Brazil to overtake Russia as second worst-hit country by Covid-19 | India cases rising fastest in Asia

Globally, the total confirmed cases of Covid-19 have reached more than 5.11 million, with over 333,000 deaths and 1.95 million recoveries.

Cases have been rising sharply in Latin America, with Peru, Mexico and Chile each continuing to experience a record number of daily cases or deaths.

Meanwhile, Brazil is set to overtake Russia with second most number of cases in the world after the US.

Cases in India are rising at the fastest pace in Asia with a record number of daily new cases.

Indonesia, the fourth most populous country in the world, is reporting a sharp rise in new cases and will be the one to watch in the near future.

Indonesia is struggling to keep the spread of infection under reasonable control compared to neighboring countries such as Malaysia, Thailand and Vietnam.

Bishal Bhandari, PhD, senior epidemiologist at GlobalData

22 May 2020

Insurance organisations reject PRIA, claiming pandemics are “not insurable risks”

Three insurance industry trade bodies in the US have rejected the Pandemic Risk Insurance Act (PRIA) in favour of their own proposal that the government carry all of the primary risk of an outbreak, and seek reinsurance privately to divest some of it.

Representative groups the National Association of Mutual Insurance Companies (NAMIC), the American Property Casualty Insurance Association (APCIA), and Independent Insurance Agents and Brokers of America, all signed off on the plan.

The proposal advises that the government use the infrastructure set up by the FEMA programme to administer payouts, and was released to counter a bill expected to be put forward to congress by NY representative Carolyn Maloney, advocates a risk-sharing agreement between the government and insurers, with the state acting as a backstop.

NAMIC president and CEO Charles Chamness said: “Pandemics simply are not insurable risks; they are too widespread, too severe, and too unpredictable for the insurance industry to underwrite.

“As we’ve seen in the past few months, pandemics are a national problem, and we need a national solution.”

22 May 2020

Why are Hiscox, Aviva and QBE facing lawsuits over their business interruption insurance?

The insurance industry has been rocked by accusations that it hasn’t honoured contractual obligations to pay out on business interruption claims, and is leaving firms without a lifeline when they need it most.

But while some of the contracts involved in policyholder disputes are, to an extent, ambiguous, others leave little room for discussion.

Hiscox, QBE and Aviva are among the insurers looking down the barrel at lawsuits in the coming days and months.

NS Insurance took an in-depth look at why some insurers are more vulnerable than others to lawsuits, and the key is in how their wording can be interpreted.

22 May 2020

Covid-19 insurance daily update: America gets first glimpse of 2021 health insurance rates – while BIBA hits back at Mactavish over critical report on brokers

The first potential rates for health insurance customers in the 2021 have been released by insurers in Vermont, Washington, and Oregon — giving an idea of what coverage might cost in 2021. According to Yahoo! Finance, almost every insurance company that referenced the pandemic stressed the unprecedented level of uncertainty for 2021, due to Covid-19. Vermont’s insurers proposed increases of 6.3% for Blue Cross Blue Shield of Vermont and 7.3% for MVP, compared to last year’s rates. Yahoo! said that MVP estimated Covid-19 was responsible for 1.6% of the 7.3%, but Blue Cross Blue Shield of Vermont didn’t mention coronavirus as a factor. Oregon insurers’ expectations ranged from a 3.5% decrease to an 11.1% increase, with Washington presenting an even more varied picture.

The British Insurance Brokers’ Association (BIBA) has hit back at claims made in a report from insurance governance consultancy Mactavish, which said brokers had a “huge conflict of interest” because they receive 80% of their income from insurers. The representative body for brokers said its members “closely follow” the FCA guidelines on managing conflicts of interest, and called Mactavish “opportunistic” for its assertion that Covid-19 had “brutally exposed” problems in the market regarding brokers’ commission, and said the firm’s report was “designed to allow them to gain from these published opinions.” Mactavish’s business model is based on advising consumer businesses in disputes with insurers.

22 May 2020

Morning briefing: Immunity certificates back on the cards in UK | Brazil’s Covid-19 death toll continues to spiral

Good morning. Here is the latest Covid-19 news from around the world.

UK: Ministers are, once again, considering handing immunity certificates to people that have antibodies to coronavirus to exempt them from social distancing rules, according to The Times. Health Secretary Matt Hancock confirmed “systems of certification” were being worked on for those who have recovered from the virus. The news comes after he revealed mass antibody testing would begin next week, beginning with key workers. The science remains a sticking point – we do not yet know for sure that those with antibodies are immune to a second infection. The paper also reports that anyone that has come into close contact with a coronavirus-positive person will be asked to isolate for two weeks, regardless of whether they have symptoms, as part of the government’s contact tracing scheme that’s due before 1 June.

Another group who will be told to self-isolate for 14 days are those arriving in the UK, under plans that will be revealed by Home Secretary Priti Patel later today. Any passengers coming in by plane, ferry or train will have to provide an address where they will quarantine – otherwise, the government will arrange a place for them to stay. Police will carry out spot checks at residences, and anyone flouting the rules faces a minimum £1,000 fine. People from the common travel area, which includes Ireland, are exempt, as are certain professions such as freight drivers and some doctors. Ministers were previously considering an exemption for France, but the idea has been abandoned. The rules are expected to come into effect next month.

Lastly, two intriguing testing stories broke overnight. First, the Guardian reported that a coronavirus “spit test”, which involves spitting into a tube rather than a throat swab, will be trialled on 5,000 police and army staff because of concerns over the accuracy of swabbing. Experts have long-pushed the government to consider the tests because they are far easier to administer. Second, the Telegraph reports that the government has double-counted tens of thousands of coronavirus tests – a story confirmed by the Department of Health. Testing numbers have been consistently higher than the number of people testing, and one of the reasons is tests that involve both a saliva sample and a nasal swab are being counted twice.

China: China will not set a GDP goal at this year’s annual Two Sessions law-making event – the first time it has failed to do so since it began publishing such targets in 1990.

Australia: Australia has called for an exemption from the UK’s upcoming two-week quarantine for incoming visitors. Under government plans, only people from the common travel area, which includes Ireland, are exempt.

Brazil: The coronavirus crisis shows no signs of abating in Brazil, which yesterday reported a record one-day death toll of 1,188, taking the total number of deaths above 20,000.

Indonesia: Indonesia recorded 973 new infections yesterday, its biggest one-day rise.

US: Around 2.4 million people filed for unemployment benefits last week, taking the total since the pandemic took hold to just under 39 million.

Read more on the New Statesman

Despite 50,000 excess deaths, Britain’s most vulnerable areas remain at risk from Covid-19

Secret data and the future of public health: Why the NHS has turned to Palantir

The case for Commonwealth: What happens when natural disaster follows disease?

Why has Kerala been so successful in tackling the coronavirus?

21 May 2020

GlobalData epidemiologist report: Worldwide confirmed Covid-19 cases pass 5 million

Globally, the total confirmed cases of Covid-19 have reached more than 5,000,000, with over 328,000 deaths and 1,900,000 recoveries.

In Europe and North America, the daily confirmed cases continue to decrease in majority of the countries.

In Latin America, Peru, Mexico, and Chile each continues to experience a record number of daily cases or deaths.

Peru has the second most number of cases after Brazil in Latin America. Cases in India are increasing at the fastest pace in Asia with a 30% increase in cases since last week.

After facing the brunt of Covid-19 in the UK, London has reported a steep decline in daily new cases with no new cases reported in the last 24 hours.

This is a positive development, but it remains to be seen if this decline in new cases will continue in the near future.

Bishal Bhandari, PhD, senior epidemiologist at GlobalData

21 May 2020

Law firm says North Carolina BI lawsuit could ‘set the tone’ for similar action

A lawsuit filed in North Carolina against insurers for the denial of business interruption coverage is “one to watch” in the US because it could set the tone for similar legal action, according to a law firm.

The approach taken in some cases filed in other jurisdictions allege that government shutdown orders were issued in direct response to evidence of physical damage to property, and so loss of income should be covered under business interruption insurance.

But Jennifer Welch, a litigation and insurance coverage attorney at law firm Cranfill Sumner and Hartzog, said the approach taken in the North Carolina lawsuit – filed by a group of restaurants and bars against various insurers – is quite different.

It means how the case is judged will be of interest both to insurers and the legal community.

“Some of the policies at issue allegedly exclude coverage for losses ’caused directly or indirectly by . . . virus’, while others do not.

“According to the complaint, however, none of the policies exclude coverage ‘for damages caused by public fear and commotion and/or governmental action implemented in an effort to prevent the arrival of the virus or to mitigate the spread of the virus as opposed to damages caused by the virus itself.’

“The complaint seeks a declaratory judgment that coverage exists under the policies, but it does not include claims for bad faith.

“This case could set the tone for similar lawsuits that may be filed in North Carolina in the coming months, so it will definitely be one to watch.”

21 May 2020

Motor insurer Sabre reports ‘extremely volatile’ premiums due to Covid-19

British motor cover provider Sabre Insurance has reported that Covid-19 has caused extreme volatility in its premium volumes, as well impacting the amount of quotes issued to consumers.

The firm said premiums were down 5% year-on-year, at £43.7m over the twelve months ended 31 March, and new business quotes were down 25% since the coronavirus lockdown began.

In its Q1 trading update, Sabre also pointed to competitor pricing and a lack of car sales during lockdown as reasons for the volatility.

Chief executive Geoff Carter said: “With market volatility expected to continue at least until the current social distancing measures start to ease, and probably for several months thereafter, it remains difficult to forecast the full-year premium outcome with any certainty at this stage.

“However, we are confident that the year-on-year reduction in premium written reflects the temporary and unique market conditions and volatility.”

21 May 2020

Bajaj Allianz CEO says 2020 will be ‘a year of survival’

The boss of insurance giant Allianz’s Indian branch says 2020 will not be a year of significant growth, but “a year of survival” for insurers in the country.

Bajaj Allianz life insurance CEO Tarun Chugh said the widescale impact on India’s economy caused by the Covid-19 pandemic will make it less likely for people to spend money on insurance premiums.

“I think this is a year of survival, not everybody is likely to invest (in policies) when the GDP (gross domestic product) is not likely to do good. This year will not be a year of significant growth” Chugh told the Press Trust of India.

“Premium for policy will actually come down. Overall on the premium for the life sector, I don”t think it will grow at all.”

Chugh added that the current situation will push insurance companies to adopt to digital and virtual means of product selling going forward – something GlobalData’s Pratyusha Mekala recently predicted.

“Web aggregators such as Policybazaar have reported 20% growth in sales of life insurance products in March 2020,” she said.

“However, growth from online channels is unlikely to prevent contraction in the overall life insurance business.”

His comments appear to square with the views of analysts from GlobalData, who predict the Indian life insurance sector is expected to contract by almost 1% during 2020, caused by disruption to the bancassurance and agency channels, which account for over 90% of insurers’ new business.

21 May 2020

ABI boss says paying claims not covered by BI policies would threaten insurers’ solvency

The Association of British Insurers (ABI) director general Huw Evans has said that paying out on claims that fall outside of the scope of business interruption policies would threaten the solvency of insurers.

His comments came in response to a letter sent to ABI chair and Allianz CEO Jon Dye by One Voice Group – a coalition of 50,000 pubs and 2,000 brewers – urging insurers to engage with the group because “the vast majority of our pub sector businesses have taken a policy including business interruption”.

In the letter, written by the group’s chairman Stephen Gould, it was claimed that industry survey data found that 1% of hospitality businesses, 3% of British Institute of Innkeeping members, and 4% of British Beer and Pub Association member companies have received a positive response from their insurer.

In a response letter, Evans said: “I can, of course, appreciate the desire to see insurers make compensation payments outside of policy terms, especially given the very difficult situation facing the hospitality sector.

“However, the scale of the problem would see the cost of such payments easily run into billions of pounds for which the insurance industry has not collected premiums or reserved.

“Such goodwill gestures could therefore only be delivered at risk to insurer solvency and require insurance executives to breach their legal and regulatory responsibilities to do nothing that will endanger the financial safety of the company.”

Responding to the expressed view that businesses were due a payout because the majority took out interruption coverage, Evans pointed to the fact that the majority of coverage was written for “day-to-day risks” such as damage to premises from fire or flood, motor accidents, supplier failure and employee harm.

“Such policies are not designed to cover a global viral pandemic of a kind we have not seen in over 100 years in this country and nor were your members charged for such cover,” he added.

21 May 2020

Covid-19 insurance daily update: Aviva expects to pay out £160m in claims related to Covid-19 – while Mactavish says brokers’ conflict of interest has led to ‘generic’ business interruption policies

The UK’s largest insurer Aviva has said it expects to pay out £160m for insurance claims related to Covid-19 after some of the cost is taken by its reinsurance partners. According to its trading highlights, life insurance sales grew by 28% to £12.3bn, compared to 2019 figures of £9.6bn, while it recorded a 3% increase in general insurance premium from £2.3bn to £2.4bn. Aviva was identified yesterday as one of two insurers facing legal action from Hospitality Insurance Group Action and its representative Mishcon De Reya. In its trading update, the insurer said it estimates business interruption claims totalling £200m, but added that the “vast majority” won’t pay out for Covid-19 disruption.

A report from insurance governance advisor Mactavish Group has revealed that 80% of brokers’ income comes from insurers, with 20% coming from clients. The firm announced the findings along with its opinion that they show a “huge conflict of interest”. The paper, entitled Broker Conflicts, also suggested that much of a broker’s revenue is directly linked to the price of premiums, so they benefit when insurance costs rise, which Mactavish said is currently happening “partly because of the Coronavirus crisis”. The consultancy also believes intermediaries have increasingly started to use over-standardised policy terms, which are often pre-defined as part of a broker scheme or facility that sees them work with “a small group of preferred insurers on mutually beneficial financial terms”. It believes This has led to the increased use of generic policies that are often not adapted for client needs, an issue it said has been “exposed” by the issue around business interruption claims that has prompted several lawsuits.

21 May 2020

GlobalData epidemiologist report: Mexico, Chile and Peru are countries to watch as they experience record Covid-19 case totals

Globally, the total confirmed cases of Covid-19 have reached more than 4,900,000, with over 323,000 deaths and 1,690,000 recoveries.

Brazil accounts for most of the daily confirmed cases in Latin America. However, countries to watch will be Peru, Mexico, and Chile as each continues to experience a record number of daily cases.

Brazil, Peru, Mexico, and Chile have each set a record high of new daily cases. In Europe and North America, the daily confirmed cases continue to decrease in majority of the countries.

It has been accepted that children are not the group most at risk from Covid-19.

However, as schools have started to reopen in Europe, it remains unclear whether they are “super-spreaders” and transmit the infection even if they are asymptomatic.

Bishal Bhandari, PhD, senior epidemiologist at GlobalData

21 May 2020

Morning briefing: UK antibody tests to begin next week | largest daily increase in global Covid-19 cases so far

Good morning. Here is the latest Covid-19 news from around the world.

UK: The government will today announce that NHS and social care staff are to be offered coronavirus antibody tests as early as next week, according to the Guardian. Hundreds of thousands of workers will be offered the test, which requires a blood sample and is carried out in a laboratory. Staff in closest contact with Covid-19, such as those in intensive care, will be given priority. The test will determine whether the person had coronavirus in the past – but scientists do not know definitively whether the presence of antibodies provides immunity against a second infection, or if it does provide immunity, how long it will last. Scientists will monitor the results of the tests to see whether those with antibodies catch the virus again. The move brings the prospect of mass antibody testing closer, but the government is still yet to approve a finger-prick home test kit, which Prime Minister Boris Johnson previously said would be a “gamechanger”.

The National Audit Office (NAO) today revealed that ministers have overruled their most senior civil servants on spending decisions 11 times since the start of pandemic. On each occasion, ministers forced through spending pledges despite being challenged by their permanent secretaries and without usual value-for-money checks. Only 75 such decisions have been taken over the past 30 years, according to the Institute for Government. The NAO found the government has pledged more than £124bn in extra spending to tackle the pandemic, higher than the £123bn forecast last week by the Office for Budget Responsibility.

Lastly, the NHS Confederation, which represents healthcare leaders, has warned the government is running out of time to introduce a track and trace strategy if it wants to avoid a second spike of infections. It said lockdown measures should not be further eased until a plan was in place. The government says a tracing system will be ready by 1 June – but without a crucial NHS app, which is still being trialled on the Isle of Wight.

World: The number of worldwide Covid-19 cases rose 106,000 yesterday – the biggest increase yet over a 24-hour period, as the World Health Organisation warned the virus was beginning to spread rapidly in poorer nations. The number of global confirmed cases has reached five million, according to Johns Hopkins University.

US: The reopening of businesses in Connecticut, Kentucky and Alaska mean that all 50 states have begun easing lockdown measures to some degree.

Japan: Japan will lift its state of emergency in Osaka and two other prefectures where infection rates have slowed.

Mexico: Mexico recorded 424 coronavirus-related deaths yesterday, its highest single-day tally. The previous record was 353 deaths on 12 May.

Greece: Greece will reopen for tourists on 15 June, when seasonal hotels will be allowed to open, the government has said. International flights will be welcomed from 1 July.

India: Domestic flights will begin running again in India on Monday, 25 May. The government has said that it will not be viable to keep middle seats empty.

Read more on the New Statesman

Too little, too late, too flawed: The BMJ’s indictment of the government’s response to Covid-19

The tragedy of Tye Green Lodge care home is a parable of government neglect

The Great Moving Left Show: How the pandemic could transform British politics

Why now, more than ever, we should bask in the glory of wasting time

I wistfully remember my last meal out pre-lockdown – at a Greek restaurant full of interesting wine

Coronavirus has changed every mundane detail of our lives – including email etiquette

20 May 2020

Analysts expect South African insurers to take a hit to GWP in 2020

Gross written premium (GWP) in South Africa is set to decline in 2020 as businesses shut up shop and the country’s economy falters, says an analyst.

GlobalData insurance analyst Deblina Mitra believes businesses, especially small and medium-sized enterprises, facing a standstill in activity, will cause a slowdown for insurers.

“South Africa responded early to the pandemic, and entering lockdown before there were many cases will help its recovery,” she said.

“However, the country had already experienced a recession in 2019, so this will further weaken its economy.

“Considering the adverse economical impact, insurers need to brace for not just potential claims but also a general decline in business.

“One area for growth will be in cyber insurance. The potential threat associated with cyber incidents during the pandemic is expected to promote the need for cyber insurance products in the country.”

According to GlobalData forecasting, the total value of GWP in the South African market is expected to decline by 3.1% in 2020, rather than the 3.4% increase expected before the pandemic hit.

The industry is then expected to recover, with analysts predicting a 1.6% compound annual growth rate (CAGR) up to 2023.

20 May 2020

German insurer launches legal notice cover for firms trading online during Covid-19 pandemic

German insurance firm Signal Iduna has released a legal notice insurance product to protect companies forced to trade online during the Covid-19 pandemic.

The coverage was designed by London-based insurtech KASKO and will ensure that any businesses pivoting to online sales save themselves stress and money in unwanted fines if they miss important disclaimers.

KASKO co-founder and CEO Nikolaus Suehr said: “This product can make a big difference to small businesses as they move their operation online in the time of crisis.

“We’re really proud of the work we have done, and know that this product will make a difference.”

According to KASKO, 47% of German online retailers have been fined for not having fully compliant websites, and for businesses moving online during the Covid-19 challenge, the average fine they risk receiving for missing key information is up to €2000.

The insurance costs customers €24.99 per month, which will cover an initial review by Signal Iduna’s partner law firms and costs associated with legal and court expenses, dunning fees and third-party damages, up to €100,000.

20 May 2020

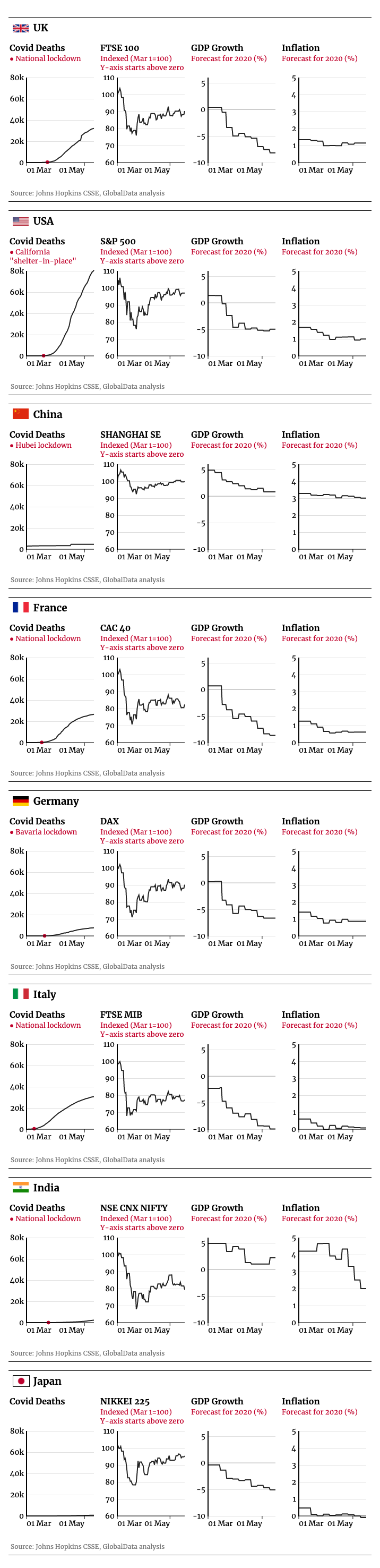

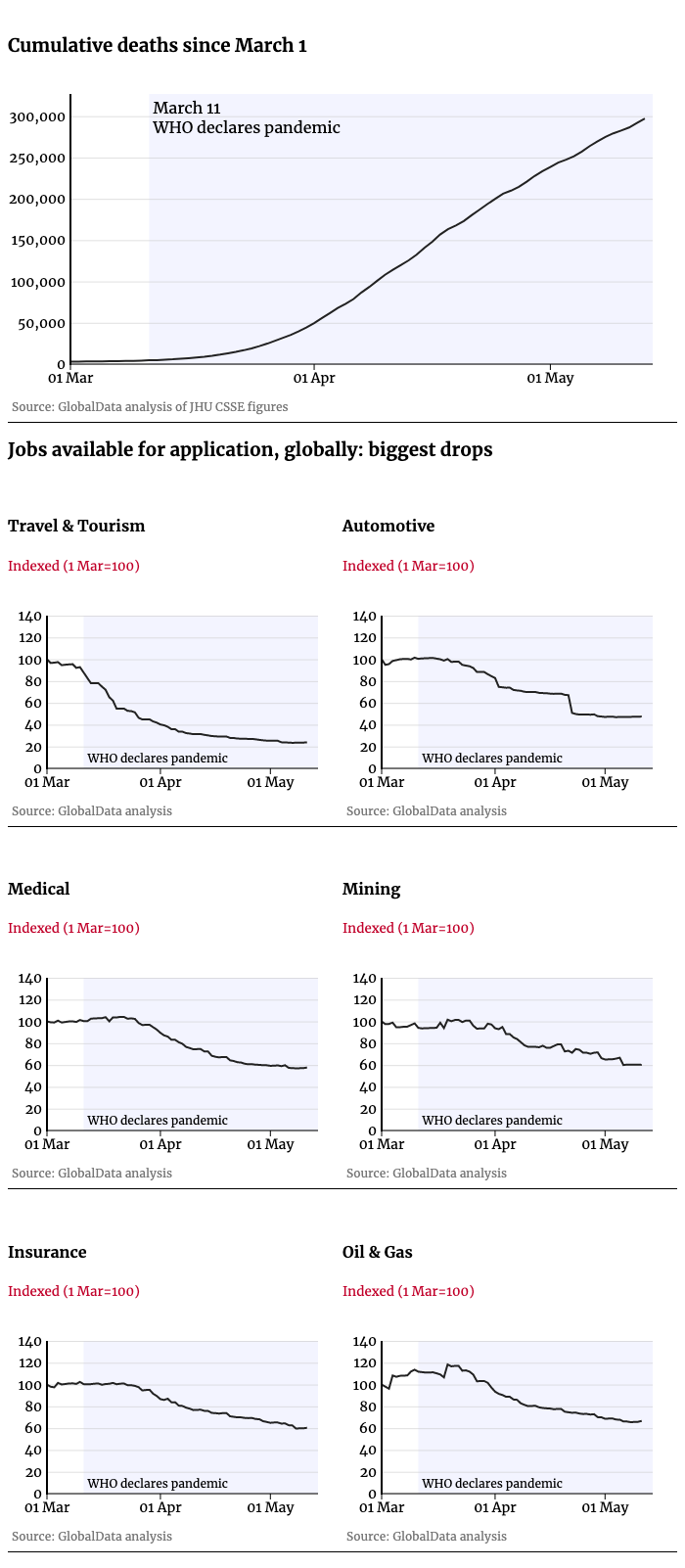

GlobalData economic forecast: Global economy to shrink by 1.9% in 2020 – with western Europe dropping by up to 10%

The global economy is now expected to shrink by 1.9% in 2020, according to experts from GlobalData.

Western Europe and the US are still expected to bear the brunt, with Italy’s GDP forecast to contract by 10% over the year.

France’s GDP is predicted to shrink by 8.6%, the UK’s by 8.2%, Spain’s by 7.9% and Germany’s by 6.6%.

Those forecasts are slightly worse than GlobalData was forecasting a week ago.

The US’ estimate has been revised upwards, however, with the country seeing a steady decline in Covid-19 cases and deaths.

GlobalData now predicts the US economy will shrink by 5% across 2020 – slightly less than the 5.3% predicted a week ago.

Latin American countries, where the numbers of Covid-19 cases are now surging, are also expecting an economic downturn. Mexico’s economy is expected to contract by 7% in 2020, Peru’s by 4.1% and Brazil’s by 4%.

China and India are among the few countries predicted to still see economic growth this year.

Covid-19 macroeconomic dashboard

We are using exclusive dynamic figures provided by GlobalData analysts to track key economic indicators in major world economies hit by Covid-19.

Deaths from the virus are plotted alongside the indexed performance of each country’s major stock exchange and the number of “active jobs” – jobs open for applications across all major industries.

Figures are tracked daily from 1 March 2020.

20 May 2020

South African giant Discovery releases Covid-19 risk tracking tool

South African insurance giant Discovery has announced several new product enhancements and services its policyholders in the country will be able to use to monitor and assess their risk of developing complications when suffering from Covid-19.

The firm said it developed the enhancements after comparing emerging experience from other parts of the world along with its own data – both of which it believes highlight the importance of regular screening, appropriate testing and understanding and managing an individual’s health risk.

Discovery South Africa CEO Hylton Kallner said: “We have undertaken the analysis to create an accessible Covid-19 risk assessment tool, that will be released on the Discovery app and the website helping people to understand their risk for Covid-19, to know their health risks that increase the likelihood of hospitalisation, and access funding for testing and health monitoring for those at a high risk for complications.”

“Members will be able to complete the assessment over time and keep track of their history. When testing is recommended, the assessment tool guides them to an online doctor consultation in a network.”

According to Discovery, high blood pressure, cholesterol, blood glucose and body mass index are leading risk indicators of developing complications.

“We want to help members on all health plans to understand and manage these factors to mitigate the risk of complications from Covid-19,” added Kallner

“From June, any result from a Vitality Health Check that places someone at a high risk for complications will trigger a referral for advice through one online doctor or nurse consultation in the network, which the Scheme (Discovery Health Medical Scheme) will fund in full.”

Discovery South Africa lists more product enhancements here

20 May 2020

Nearly 40,000 coronavirus deaths in England and Wales, ONS says

About 50,000 more people than expected have died in England and Wales since the start of the coronavirus outbreak, writes Nicu Calcea.

New figures released by the Office for National Statistics (ONS) this morning show an estimated 49,647 “excess” deaths occurred from 14 March to 8 May, with 39,071 of those attributed to Covid-19.

The good news is the number of weekly deaths, both caused by the virus and overall, is now at its lowest since the start of April.

While all regions in England and Wales experienced a decrease in deaths attributed to Covid-19, the north-west overtook London for the first time as the epicentre of the outbreak with 597 deaths in the week to 8 May.

The number of people dying in care homes has also been falling for two consecutive weeks, with 1,666 coronavirus-related deaths recorded in the first week of May compared to 2,423 during the previous week.

However, the share of care home deaths that were attributed to Covid-19 has had a small bump, with 39% of deaths now linked to the disease.

The UK as a whole has recorded about 55,000 excess deaths, ONS statistician Nick Stripe told the BBC.

20 May 2020

Hospitality Insurance Group Action focuses legal action against QBE and Aviva

Hospitality Insurance Group Action (HIGA) has confined its planned group action lawsuit over denied business interruption claims to two insurers – QBE and Aviva.

Legal representative Mishcon De Reya – which is also handling a group action against Hiscox – is calling on all hospitality industry businesses with relevant policies to join the group action by 5 June.

The firm plans to move forward on 10 June, with the aim of issuing a claim as soon as possible thereafter.

According to the Mishcon, the relevant wording can found within the following:

Aviva: Material Damage & Business Interruption Policy

QBE: Hotel Insurance Policy, Leisure Combined Policy, Business Combined Insurance Policy and Nightclub and Late Night Venue Policy

HIGA is now writing to all its applicants inviting only those policyholders with these insurers and specified policies to confirm that they remain interested in participating in a funded group claim.

Mishcon said the firm is still in negotiation with third parties to obtain legal funding.

20 May 2020

How has Covid-19 impacted global expansion strategies? Tell us your views in new NS Media Group survey

The Covid-19 crisis is causing companies to rethink their global expansion strategies.

The UN Conference on Trade and Development estimates global foreign direct investment flows will contract by as much as 40% over the next year.

But is the impact equal across all sectors and geographies? Where will companies pull back from, and where will tomorrow’s opportunities most likely be found? How are companies changing their modes of entry for new markets in order to adapt to the current conditions?

NS Media Group — which is set to launch a dedicated information service focused on corporate cross-border expansion — is running a short survey to help answer these questions and would like to hear directly from executives in multinational companies involved in overseas investment decisions as to how corporate strategies are evolving.

This is an essential piece of research to better understand the impact Covid-19 is having in global business and investment.

20 May 2020

Covid-19 insurance daily update: Insurers face accusations they reneged on business interruption agreements – while today marks the deadline for firms to submit evidence for the FCA High Court test case

The Night Time Industries Association has claimed that it has heard “countless stories” of insurers giving written confirmation to policyholders that they’re covered for coronavirus-related losses, and then denying a claim later down the line. In one example, that of security services firm Senate Group, it’s claimed the insurer Hiscox sent a written confirmation in February before the lockdown that said it would pay out up to £100,000. Despite this, the Bermuda-based provider has denied Senate Group a payout, and others, claiming its “core policy wordings do not provide cover for business interruption as a result of the general measures taken by the UK government in response to a pandemic”.

The channel for submitting evidence to the FCA for consideration when it brings a test case on business interruption issues to the High Court closes today, according to the regulator’s website. On 15 May the FCA put out a call for evidence from any business with a disputed claim it believed should be paid, and was denied wrongly. Each of these cases will be assessed by a legal team led by Herbert Smith Freehills partner Paul Lewis, before they’re brought to the High Court for a ruling. The regulator has said that the outcome of the ruling will only be legally binding on the claimants and insurers involved in the test case, and will not prevent others from taking legal action over a denied claim. The aim however, is for the outcome of the case to provide “persuasive guidance for the interpretation of similar policy wordings and claims,” according to the FCA.

20 May 2020

Morning briefing: UK track and trace system runs into problems | 60m people could be pushed under poverty line by pandemic

Good morning. Here is the latest Covid-19 news from around the world.

UK: The government is coming under mounting pressure to roll out a track and trace system that, clearly, isn’t yet fit for purpose. The Guardian reports that the system, which will involve more than 20,000 contact tracers as well as an NHS app, will not be ready until June – Health Secretary Matt Hancock initially said it would go live in mid-May. Multiple government scientific advisers warned last night that schools should not open until an effective system is in place and working well.

Even leaving track and trace aside, more and more councils are saying they intend to keep schools closed for the start of next month. The BBC says at least 11 councils have expressed opposition to the date – the Guardian claims it’s 18, representing 1,500 primary schools. However, opposition from the British Medical Association appears to be softening. The organisation said schools can reopen on 1 June if it is “safe to do so”, and that there is “growing evidence that the risk to individual children from Covid-19 is extremely small”. Meanwhile, Mary Bousted, the joint general secretary of the National Education Union (NEU), admitted her union’s opposition to the 1 June opening was a “negotiating position”.

Lastly, a BBC Radio 4 documentary has told of the pressure care home managers came under to accept patients from hospitals who were potentially carrying Covid-19. A 2 April government directive called for a national effort to clear hospital beds, while two councils wrote to care homes suggesting that extra funding was conditional on them taking patients from wards. Susan Mckinney, who runs 14 care homes in the north-east, recalled: “We had an incident on 10 April where twice we rang the hospital saying ‘we can’t accept this person back, we need them tested, we need a negative test so we know what we’re dealing with,’” she said. “They turned up at the door in an ambulance and refused to go away. There was a sort of stand-off at the door of the home… We were threatened with the police if we did not let this person in.”

World: The pandemic could undo three years of alleviating inequality and push 60 million people below the poverty line, the head of the World Bank has warned.

US: President Donald Trump said that having the highest number of coronavirus cases worldwide was a “badge of honour” because it showed the US had the best testing system. He also called a US study showing that hydroxychloroquine had limited effectiveness against coronavirus a “Trump enemy statement”, after he revealed he was taking the drug as a precaution.

Brazil: Brazil recorded its highest daily rise in both deaths and cases. It reported 17,408 new cases and 1,179 deaths in a 24-hour period, taking the official death toll to 17,971.

India: India recorded its biggest one-day spike in infections, with 5,200 new cases. It has begun to ease what was one of the world’s strictest lockdowns.

Singapore: A man has been sentenced to death via a Zoom call for his role in a drug deal – the first case where capital punishment has been delivered via a remote, virtual hearing. The country also set out a phased approach to ending its partial lockdown from 1 June.

New Zealand: Prime Minister Jacinda Ardern has urged employers to consider a four-day working week to allow people to travel the country and achieve a better work-life balance.

Fiji: Fiji has asked to be included in the travel “bubble” between New Zealand and Australia, which is allowing free movement between the two countries.

South Korea: High schools in South Korea reopened today. It marks the beginning of a phased reopening of the country’s school system.

Netherlands: Bars and restaurants will reopen on 1 June provided customer numbers are limited and people follow social distancing measures, the government said.

Canada: Canada and the US have extended their border closure for non-essential travel until 21 June.

Read more on the New Statesman

Reopening schools is a question of logistics, not of risks

Why the Covid-19 crisis will force the UK to rewrite the economic rulebook

Coronavirus is introducing the pitfalls of Universal Credit to many new claimants

Senior but still citizens: we should not disregard the contribution of elderly in this pandemic

Michigan governor Gretchen Whitmer stood up to Trump. Can she stand up to her own people?

19 May 2020

GlobalData epidemiologist report: True impact of Covid-19 in Africa unclear – but demographics could spare it from high death toll

Globally, the total confirmed cases of Covid-19 have reached more than 4,810,000, with over 319,000 deaths and 1,790,000 recoveries.

In Europe, the daily confirmed cases continue to decrease in the majority of countries, except Russia, which continues to experience an increase in cases.

Brazil, in Latin America, and the US, in North America, account for most of the reported daily confirmed cases in that continent.