The FCA has chosen 16 insurers reflecting 17 policy wordings for its business interruption test case, but the Hiscox Action Group will still act separately in an effort to obtain a payout for hundreds of businesses disrupted by Covid-19

The FCA hopes to bring clarity through its ruling so it can be used to resolve other business interruption disputes (Credit: PxHere)

The Financial Conduct Authority (FCA) has selected 16 insurers for its High Court business interruption (BI) test case in July, but the Hiscox Action Group believes its own lawsuit will lead to a quicker resolution for its members.

The UK regulator said it reviewed more than 500 relevant policies from 40 insurers before whittling the number down and choosing 17 policy wordings it believes are most representative of the key issues in dispute.

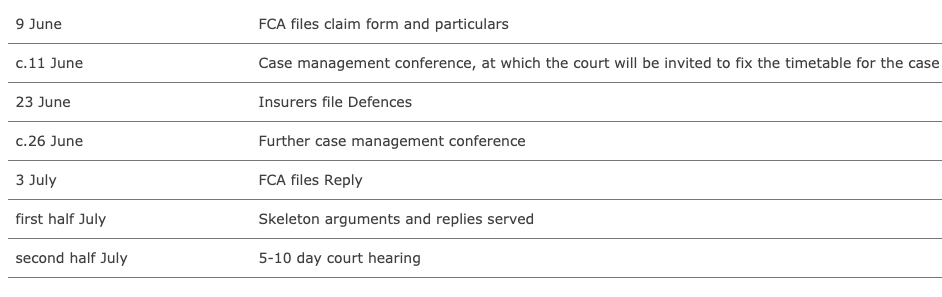

Based on its current timeline, insurers have been given until the 23 June to file their defences as the FCA expects to bring the test case to court in the second half of July.

But the Hiscox Action Group, which is pursuing a £40m ($50m) lawsuit against Bermuda-based Hiscox, says this is too long.

FCA interim chief executive Christopher Woolard said: “The court action we are taking is aimed at providing clarity and certainty for everyone involved in these BI disputes, policyholder and insurer alike.

“We feel it is also the quickest route to this clarity and by covering multiple policies and insurers, it will also be of most use across the market.

“The identification of a representative sample of policies and the agreement of insurers who underwrite them to participate in these proceedings is a major step forward in progressing the matter to court.”

Rather than select firms by market share, the regulator said it identified policies and insurers representative of the key arguable issues while minimising the number of parties engaged before the court to speed up the process.

As the FCA previously announced, the rulings given throughout the test case will be legally binding on both the insurers and policyholders involved – but they will not prevent policyholders from pursuing litigation separately.

Despite this, the regulator did issue guidance to insurers to check the wordings in their policies, expecting any affected by the results of the test case to reassess denied claims and where they uphold the decision, give claimants a full explanation of why their claim was still denied despite the test case ruling.

The FCA said it remains steadfast in its view that most SME insurance policies are focused on property damage and only have basic cover for BI as a consequence of property damage.

Its test case will be focused on the remainder of policies that could be argued to include cover and be triggered by the coronavirus pandemic.

Hiscox Action Group doubles down on its choice to litigate outside of the business interruption test case

The FCA announced it would pursue a test case to provide clarity over business interruption claims disputes on 1 May amid hundreds of businesses seeking to challenge their insurers through group action lawsuits.

One of the largest of these business conglomerates was the Hiscox Action Group (HAG), which expects to bring an expedited arbitration claim against Hiscox imminently.

Speaking to NS Insurance, HAG co-founder Daniel C Duckett said the “extremely lengthy timeline” set out by the FCA “reinforces our [the HAG’s] decision” to push forward with its lawsuit.

“With a hopeful court date in late July that could last at least two weeks, that would push an initial decision into August,” he said.

“This doesn’t take into account the appeals process, which would again push a final decision back months or potentially years.

“The HAG firmly believe the insurance industry will push back until all avenues are exhausted in an effort to dissuade claims.”

The FCA’s current advice to businesses with a dispute over interruption coverage is to submit their case to the Financial Ombudsmen Service (FOS) – the UK’s dispute resolution authority.

The regulator previously advised that the outcome of the test case will inform future resolution decisions made by the FOS, but Duckett said such resolutions are likely to be stayed pending completion of the test case.

“We are instructing our members that the FOS route will be stayed pending that outcome so complaints may not be heard for quite some time,” he said.

“Given there is no appeals process to arbitration, we are in a much stronger position to get a resolution quickly.

“Mishcon are finalising our legal action and we hope to be in a position to act in the very near future.”

Duckett says Hiscox implication in test case should help his group in its legal challenge

The FCA gave a preliminary list of insurance policies alongside its update statement it said matched the 17 policy wordings it will seek clarity on from the High Court.

More than 30 Hiscox policies appeared in the list alongside those of other firms, including Aviva and QBE who will also be defending a legal challenge in June.

Duckett believes the breadth of Hiscox policies in the test case will aid his own group’s efforts to obtain redress through an arbitration proceeding.

“We are very satisfied that so many of Hiscox’s wordings are included in the action as they have pushed back the hardest,” he said.

“Now that the wordings are public and available to anyone, it will be much harder for Hiscox to defend their position on such loose wording.”