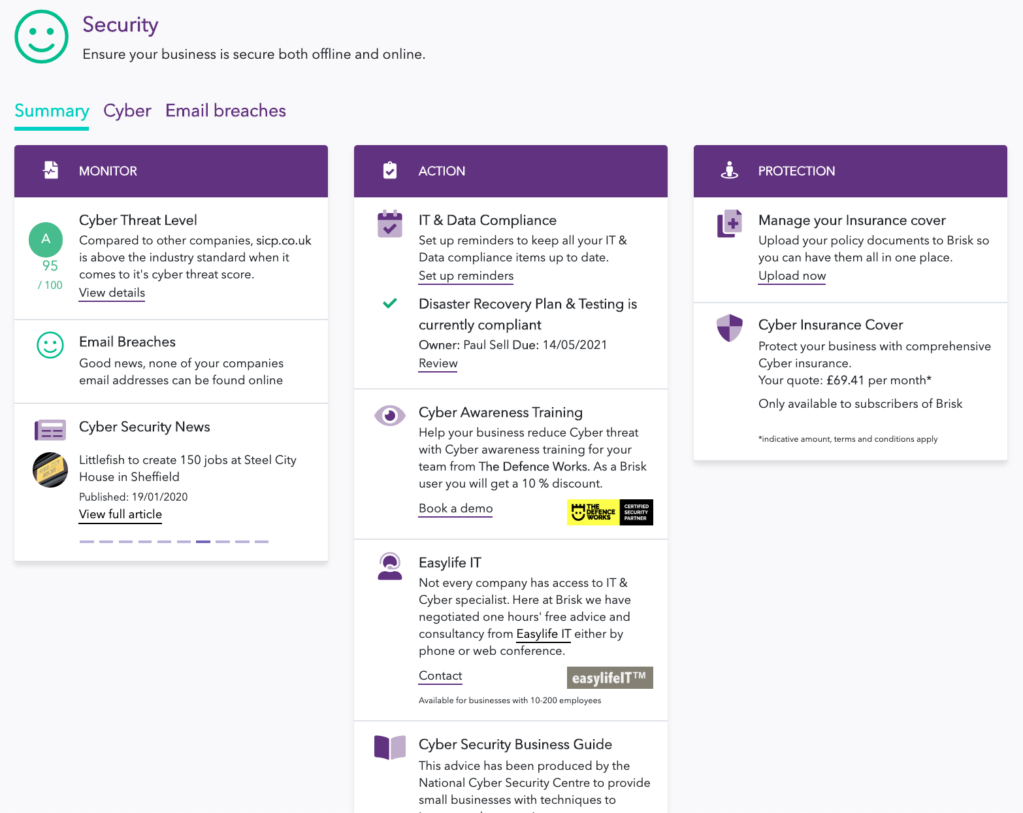

Brisk provides a digital adviser to small businesses that helps them manage their risks and address them with appropriate insurance coverage

Brisk's risk-advisory platform works across smart devices and desktops (Credit: Brisk)

For a smaller business without the resources of a big firm — a number of uninsured loss events can cause untold financial damage that could ruin them altogether. Peter Littlejohns speaks to James Russell, a former digital transformation leader at industry giant Aviva about how he’s shining a spotlight on these risks with his start-up venture.

As companies grow in scale and the need to protect both their assets and operations increases, the chances are they’ll consult a third-party or hire a risk manager to ensure they have the correct coverage in case disaster strikes.

But not only do smaller companies tend not to purchase cover, but their risk knowledge is also rarely adequate to have a rounded view of where they need coverage.

Enter Brisk, a subscription-based platform founded in 2018 to help small and medium-sized businesses gain insight into their risk exposure using a suite of digital tools.

Founder and CEO James Russell says: “Small businesses are really busy, they haven’t got time to check documentation and a lot aren’t even aware of what their risks are and what insurance needs they have.

“That’s why brokers exist, but smaller brokers haven’t got the time or efficiency to really give to a small business.

The cost of consulting a broker is another barrier to addressing risk, which Russell compares to his time as a management consultant for Ernst and Young (EY), as smaller businesses didn’t have the money for the firm’s services.

“So I thought, what if we use data and AI technology to bring a virtual risk manager and adviser to small business owners,” he adds.

What drove the creation of Brisk and its insurance adviser?

In his former roles at British insurance giant Aviva, Russell managed the claims strategy of the business, including its use of analytics and its relationships with brokers.

During this time, he gained an insight into the shortfall in understanding and financial capacity present within small businesses, which resulted in them failing to address their risks adequately.

“Brokers and big insurance companies put a lot of effort and focus on big companies because the premiums are very big and so are the commissions for brokers, so they can justify spending a lot of time on them,” he said.

“But then you see claims coming in from small businesses, and they might be related to things that they just didn’t have covered because they didn’t know they could, so the claim wouldn’t be paid.”

To give an insight into the scale of underinsurance, Russell refers to a study from government-backed insurer Pool Re that found 43% of local businesses interviewed following the May 2017 Manchester Arena attack didn’t have a disaster recovery plan in place.

Brisk’s co-founder Greg Duffield came on board because he’d felt the pain Russell wanted to address firsthand, while trying to get insurance working within a small business himself.

“He was frustrated that he would get a one-size-fits-all insurance policy in which he’d be paying too much or too little, he just didn’t really know.

“He felt that the protection insurance afforded him could be smarter and more intelligent, so he was motivated to use his technology skills to modernise it.”

After holding several senior roles at fleet-management software business Proteo UK, which specialises in collecting data on driving behaviour through telematics, Duffield brought the technical know-how needed to make Russell’s vision a reality.

The final piece of the puzzle the duo needed was early-stage investment — something industry influencer Rob Galbraith recently referred to as “rocket fuel” — which they secured by participating in London start-up accelerator programme Founders Factory.

What risks does Brisk’s dashboard highlight?

Brisk operates as a middle man, otherwise known as an intermediary, connecting small businesses with coverage bought through its platform and provided by partnered insurance companies.

It works with fellow insurtech Certua to facilitate the connection between the cover providers and its customers.

“They do the smart layer of technology that talks to the underwriting backend in the insurance company, so all of the underwriting rules are managed by those two parties,” says Russell.

But the core of Brisk’s proposition to businesses is giving them a way to accurately assess their risk exposure, so when they buy coverage firms can be sure it’s fit for purpose, or if they choose to risk-manage their exposure, they can monitor the effectiveness of their actions.

“The feedback we get from businesses is that they don’t want complex dashboards and analytics, they just want us to tell them what’s happening and what they should do about it, or give them some options,” says Russell.

Through a partnership with US firm Security Scorecard, cyber risk data is compared with other companies working in a client’s sector to score them based on their peers.

The cybersecurity firm also uses software to crawl hacker forums for company mentions, adding the level of “hacker chatter” to its score of how at risk a small business is.

If a cyber breach becomes publicly available information, Brisk’s software will pull in the information from the web and notify all of the businesses using it and suggest that they change the password on the compromised website, as well as any others for which they use the same one.

A second risk the start-up focuses on is employee health, offering a tool that tracks absences and sickness similar to a piece of HR software.

It then analyses the data to see if patterns emerge that might suggest an employee needs intervention for burnout or a mental health issue, as well as whether the risk they pose to business income needs to be addressed with insurance.

“The analysis all happens behind the scenes, we just tell them what we’re seeing and what risk it could pose and what they should do.”

Prices for the risk advisory platform designed by Brisk start at £25 a month, with the option to extend its functionality for a premium.

What’s next?

Brisk is in the early stages of its development, looking to raise £500,000 this year to extend its runway to grow.

Its long-term vision goes beyond insurance, for which it has one firm product ready, and another incoming.

“We’re looking to provide everything, from insurance to loans, but at the moment we provide cyber insurance and we’re also about to bring on short-term income protection,” says Russell.

In the longer term, the start-up wants to leverage Duffield’s fleet-management technology to add the ability for small businesses with vehicles to monitor their driver-specific exposure, and add the option of insurance coverage to address it.

Another strand of the business that developed through customer demand is providing Brisk’s toolset to brokers with small business clients.

But Russell’s ultimate vision for the platform is that it will become a one-stop-shop for services that address the varied risks a small business might have.

“We’re continuing to build the risk-management dashboard by pulling in different data sources.

“In parallel to that, we’re adding insurance protection across a business’s people, assets, and vehicles, so they can not only monitor risk and spot opportunities, but access financial services products like insurance or loans.”