Rivals of Lloyd's of London have capitalised on the withdrawal of several syndicates to increase their share of the marine and cargo insurance market

(Credit: PxHere)

Insurance companies and brokers in the London Company Market, alongside firms in the Asia Pacific, US and Scandinavian regions, are capitalising on higher marine and cargo insurance rates after several Lloyd’s syndicates withdrew from the sector.

Premiums for cargo insurance have jumped to between 12% and 14% in the wake of an increase in the volume of claims over the past five years, and other marine insurance rates are experiencing a similar upward trend after an increase in catastrophe losses in the past two years.

Insurance brokering giant Gallagher said in a February report that 10 Lloyd’s syndicates have withdrawn or reduced their business in the sector, which has benefited the smaller London Company Market.

Alexander Mott, marine director at insurance brokerage AFL, told Reuters: “The London Company Market has demonstrated greater flexibility in its approach, as have other European markets, particularly France and Scandinavia.

“The Lloyd’s market is still the most important marine hub in the world, but it needs to adapt … rather than hoping that business will simply come back.”

In 2018, Lloyd’s controlled about a fifth of the world’s marine insurance market, but it reviewed a number of loss-making syndicates in the same year with a view to urge them to trim their marine insurance risk, resulting in several exiting the sector completely.

According to the International Underwriting Association, its marine insurance and reinsurance gross written premiums totalled £3.8bn in 2017.

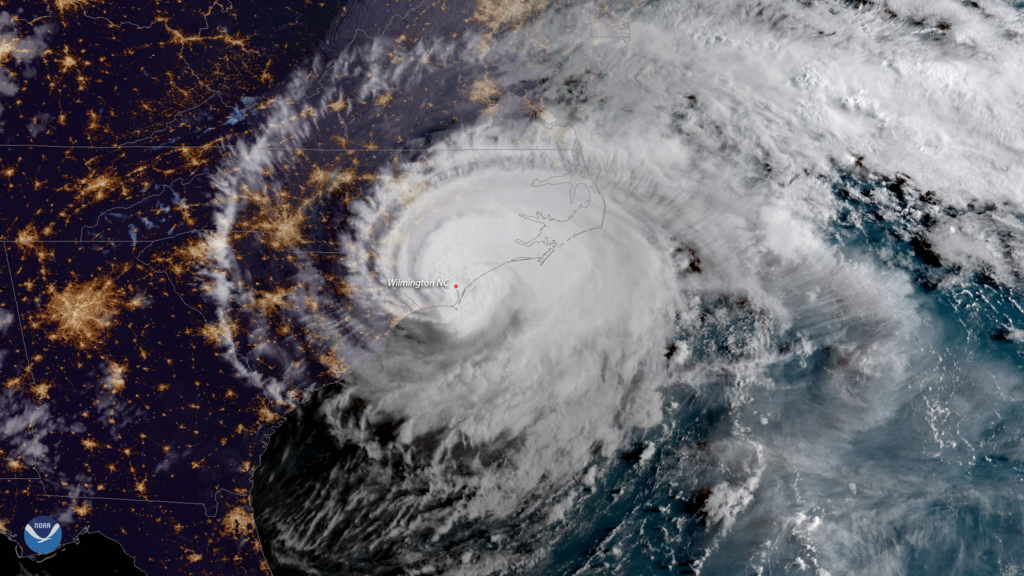

Lloyd’s recorded two years of losses caused by natural catastrophes

Lloyd’s is still reeling from a raft of claims on policies backed by its syndicates that were made after natural disasters in the past year, including hurricanes Florence and Michael, which hit North America, as well as the California wildfires, all of which have contributed to its $1bn (£783m) loss reported for 2018.

But it wasn’t the only insurance market to suffer from the increase in natural disaster activity, with Swiss Re Sigma, the research arm of the reinsurance giant Swiss Re, estimated insured losses to be $76bn (£59bn) in the year.

The combined insurance losses from natural disasters in 2017 and 2018, meanwhile, were $219bn (£171bn), the highest recorded by Sigma for any two-year period.

The total cost to the Lloyd’s market from natural disasters in 2018 was $2.9bn (£2.2bn).

Lloyd’s expects to return to profit in marine and cargo insurance sector

Lloyd’s CEO John Neal told Reuters it will take the market between 12 and 24 months for Lloyd’s marine insurance business to return a profit, already having seen signs of better performance during the first quarter of this year.

He urged syndicates to be cautious of the insurance contracts they take on, adding that the prices given should reflect the level of risk and that syndicates should take into consideration whether certain marine business was insurable at all.

Although marine insurance accounted for 7% of business at Lloyd’s in 2018, down from 8% a decade ago, it remains a bigger part of the business than energy, motor or aviation.