Distributed Ledger Technology has already made waves across several industries due to the security and efficiency benefits a blockchain provides

Several companies are making a play to bring blockchain into the insurance industry

Blockchain has been a common buzzword since major cryptocurrency Bitcoin became a roaring success, but the technical work behind it is called Distributed Ledger Technology (DLT). After seeing the value of securing contracts and cutting back-office costs across its value chain — the insurance industry is beginning to flirt with DLT to improve its own business. Peter Littlejohns takes a look at the tech firms vying for its attention.

Huge companies within the insurance industry have been backing blockchain technology provider B3i since it decided it wanted to develop DLT for providers back in 2016.

At a product launch event this week CEO John Carolin urged players in the insurtech market to approach his company and use its technology to build their own products.

But despite his bold statement, B3i isn’t the only actor trying to bring blockchain into the insurance industry.

Five companies using Distributed Ledger Technology to enhance the insurance industry

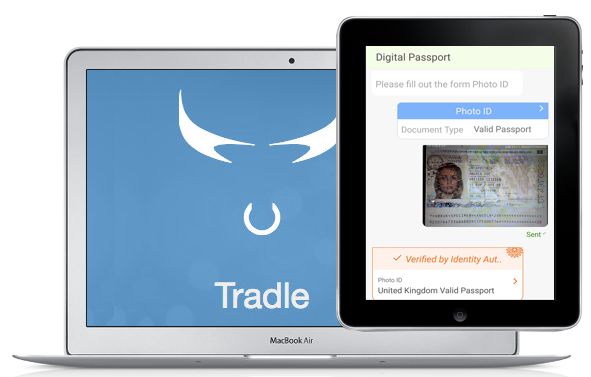

Tradle

Know Your Customer, Know Your Client, or simply KYC is the process an insurer must go through to verify the identity of a customer, how suitable they are to do business with and whether they pose a fraud risk.

The traditional process differs by country, but usually involves gaining the name, address, date of birth and a photograph of new customers, before checking these against consumer reporting agencies and public databases.

Founded by Gene Vayngrib in 2014, Tradle is a technology company built on the DLT framework of open-source company Corda that has both banking and insurance applications.

Its DLT platform works across traditional desktops as well as smartphones and tablets, and allows customers to share any of the above information with insurers through a smart device or web app that looks similar to a messaging service such as WhatsApp or WeChat.

Because of the decentralised nature of a distributed ledger, details stored within the platform are immune to hacking, and when customers switch insurance providers, their KYC data can be automatically shared with the next company without it needing to be checked.

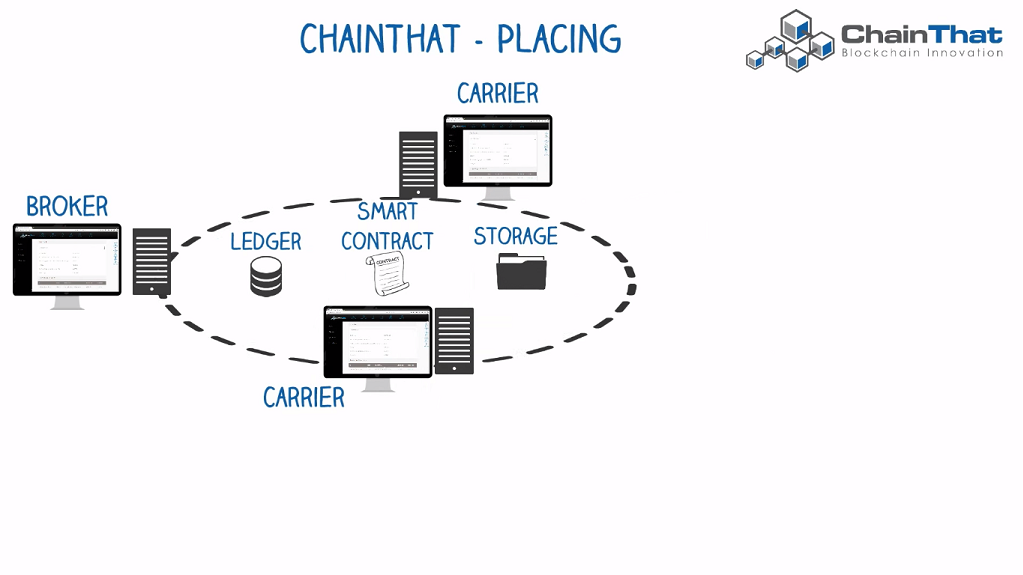

ChainThat

A distributed ledger has several applications in the world of insurance, and some companies are spanning more than one of them.

ChainThat is one such company. Founded in 2015 by David Edwards, it has a suite of products that rely on the benefits of a distributed ledger for their value.

The insurtech is currently implementing a stage-based plan to transform the Bermuda Risk Exchange — one of the world’s largest reinsurance markets — into a blockchain-driven operation.

The project will impact how risks are placed, how accounting is done and how claims are handled, with the manual processes attached to each completely digitised and each member of the value chain having a single source of truth.

But ChainThat also has products that bring the risk-placing workflow relationship between brokers and insurers onto a distributed ledger, creating a digital signature for policies and saving each party from having their own related legal documents.

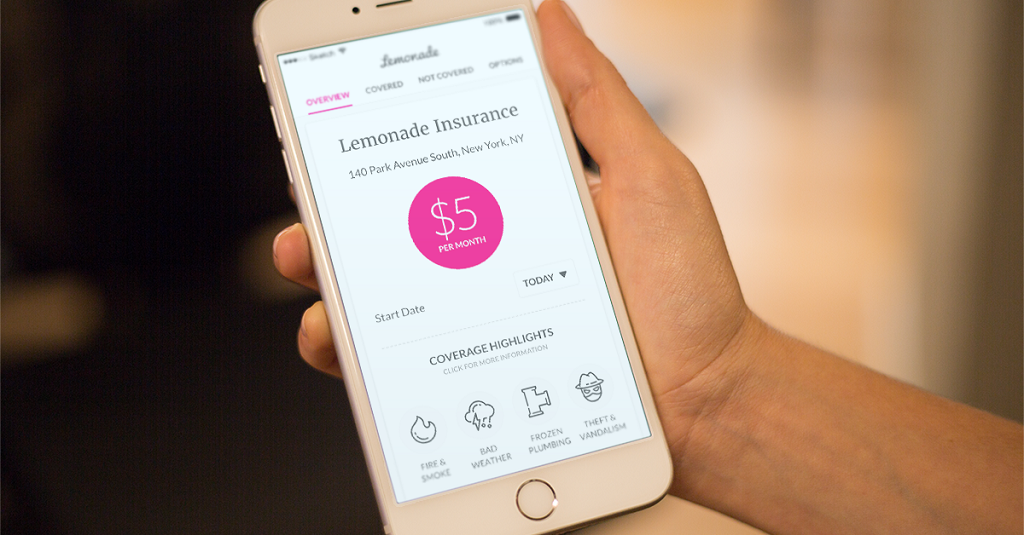

Lemonade

Lemonade will be the name most familiar to those reading this list, as the insurtech took the industry by storm when it turned the original concept of insurance on its head.

Founded in 2015 by CEO Daniel Schreiber and chief operations officer Shai Wininger – also founder of freelancer marketplace Fiverr — the company uses AI and blockchain to provide peer-to-peer home and renters’ insurance.

Lemonade structured its business to eradicate bias from the process of submitting and paying claims by pooling customers by the charity they choose upon sign up.

It then takes 20% of the pooled funds and leaves the rest for claims, with any not paid out going to the chosen charitable cause.

What’s not commonly known, however, is that the peer-to-peer transactions at work when claims are paid operate on a distributed ledger via smart contracts — a digital policy that pays out instantly once a claim is verified.

Unlike other smart contracts that rely on a parametric occurrence like an extreme weather event to trigger — Lemonade relies on AI-based algorithms to establish claim legitimacy and the behavioural economics of customers not wanting to take money away from their chosen cause to dissuade them from exaggerating the cause of loss.

Black

A lesser-known company soon to enter the insurtech space with a blockchain-based product is Black.

The start-up was founded in 2017 by serial entrepreneurs Bundeep Singh Rangar and Risto Rossar.

Its objective is to use blockchain and cryptoassets to allow insurance intermediaries like managing general agents (MGAs) and brokers to crowdfund their underwriting capacity — circumventing the need to accept low profit-sharing rates from major insurers.

The company has a working prototype of its software, the Black Platform, which allows brokers to create insurance products, insurance syndicates to fund them with underwriting capacity, and investors to give syndicates the money they need to do so.

All of the financial transfers take place through the purchase of Black Syndicate Tokens (BST), a cryptocurrency that has its value tied to the performance of an insurance syndicate’s investment performance, and by extension to the insurance portfolios they invest in.

The start-up attempted to raise launch capital through an Initial Coin Offering (ICO) — a fundraising event in which people invest through purchasing the company’s cryptoasset — in 2018

But it failed, raising $40,000 of its ambitious goal of $10m — it has since returned the money to investors and sought seed funding from elsewhere, adamant it will launch in 2020.

Etherisc

Smart contracts work most efficiently when they’re tied to a verifiable source of information, such as a weather service or flight schedule.

Insurtech firm Etherisc is providing the means to make such policies a reality, companies and individuals can insure things that traditional players in the market may not have the appetite for.

Founded in 2016 by Renat Khasanshyn, Christoph Mussenbrock and Stephan Karpischek, the company’s wider ambition is to make insurance companies redundant, by creating a platform in which anybody can create products to cover a range of eventualities.

In such a system, capacity will be given through the sale of cryptoassets known as tokens, much like in Black’s model.

Etherisc is solely focused on parametric occurrences, with the two main applications of its distributed ledger currently crop insurance and flight delay cover.