AM Best's latest report chimes with recent comments from insurance experts on how captives will influence the landscape during the current hard market

AM Best expects to see an increase in the number of captives as well as the amount of risk they insure (Credit: PxHere)

The use of captives may increase to fill the insurance gap left as certain coverage products become unavailable or unaffordable for many in the commercial market.

This is the message from AM Best in its latest report, which highlights the strong performance of captives in comparison to the commercial insurance market in the US over the past 10 years.

The current hardening of the commercial market, the ratings agency believes, may increase the level of risk businesses insure in their captives, as well as lead to new captive formations.

The report said: “The difficulty and expense of placing insurance in a hard market may encourage enterprises to expand the use of their existing captives, form new captives, or a combination of both, as part of their risk-management strategies.

“As a result, captives are balancing risk appetites with self-insurance savings in determining whether, or how much, to increase net retentions or to participate up the reinsurance tower to manage costs.

“Firming commercial insurance prices and reinsurance capacity shortages are examples of recent market developments that are contributing to market dislocation and could continue for years to come.”

This last statement echoed the thoughts of several captive insurance experts, who recently told NS Insurance that the Covid-19 pandemic is likely to push an already hard market into a state comparable with that last truly hard market of the 1980s.

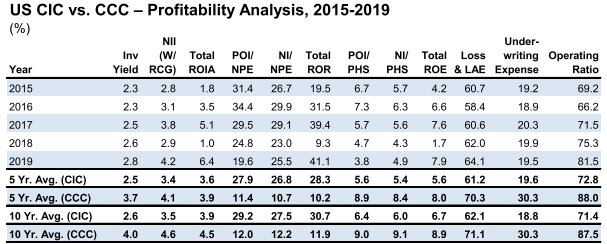

According to AM Best, data from the 140 US entities included in its captive insurance composite (CIC) showed a lower average operating ratio than the commercial casualty composite (CCC) it uses as a base for comparison against the insurance market.

“Although captive insurers are not intended to be revenue centers, they typically create natural efficiencies that often result in significant underwriting profitability and overall earnings,” the report explained.

“Underwriting profit can be viewed as the insurance expense savings that stakeholders would otherwise pass on to traditional commercial insurers.

“As such, retained earnings through profits remain the pronounced driver of capital growth for the [CIC] group.”

Why do captives outperform the commercial insurance market?

A captive insurance company allows a firm, or group of firms, to protect themselves against risks by writing policies tailored to their interests and deciding how much of that overall risk they want to retain, and how much they want to transfer to the reinsurance market.

AM Best believes this ability to align coverage with the specific needs of insureds, and the fact that they have an interest in managing the risk to maximise their profit and control losses is what leads them to perform better than the commercial market.

“Captives generally outperform the commercial market owing to the close alignment of interests with their stakeholders, with homogenous risks, risk management, loss control, and safety programs as vital elements for the business(s) placed in the captive,” added the report.

“As a result, captives tend to have consistent business profiles, good risk selection, and fair pricing, and rarely compete with commercial insureds.

“Captives enjoy a position of minimal competition with the commercial market, with renewal/member retention rates well over 90% for the rated group captives and RRGs (Risk Retention Groups).”