The company says it has created automated machine learning and recently received a $206m boost in investment from those banking on its future success

DataRobot has a total of $430m in funding (DataRobot)

One to watch in the insurtech data science and machine-learning field, DataRobot appears to be going from strength to strength, and a recent windfall of investment suggests it won’t be slowing down anytime soon. Peter Littlejohns examines the roots of the company and how it’s changing the insurance industry.

Data science forms the core of many of today’s successful businesses, with experts in the field plying their trade to build models that predict anything from changes in the market to the risk of an insurance claim.

Predictive modelling involves using statistics to accurately foresee a future outcome, and actuaries have used it in ever more sophisticated forms since the inception of insurance as a business model.

But within the past decade, and especially in the previous three years, the widespread proliferation of machine learning in different markets, including insurance, has supercharged the speed and accuracy of these models to the point that many processes can be completely automated.

One company at the forefront of machine learning application is DataRobot, a software company that gives insurance firms the tools required to apply predictive modelling on their own datasets, condensing and automating numerous data science techniques in a software package.

The industry has responded positively to the firm’s move to democratise the use of data science, with it being branded a “visionary” according to global market researcher Gartner’s Magic Quadrant for Data Science and Machine Learning Platforms — an annual report on the key players in the field.

Another sign of progress is the $206m in investment it reported earlier this week, led by venture capital firm Sapphire Ventures, bringing its total funding to $431 million.

What is DataRobot?

Headquartered in Boston, Massachusetts, DataRobot is a software company that builds products for businesses looking to extract value from their data.

Founded by Jeremy Achin and Tom De Godoy in 2012, the company came into being after the pair decided to leave their data analytics roles at US insurer Travelers.

There has long been concern over a lack of data science professionals in most industries, with this especially prominent within the insurance sector.

With this growing demand from companies to extract value from their data, the DataRobot founders decided software that makes predictive analytics accessible without the need for rigorous training was the obvious solution.

DataRobot now has 18 offices across the US, Europe and Asia — including an entire department dedicated to applying its product to the insurance industry.

DataRobot created automated machine learning

Machine learning is a subset of AI that involves the training of a model that can output an action or prediction after it’s given a dataset to work from.

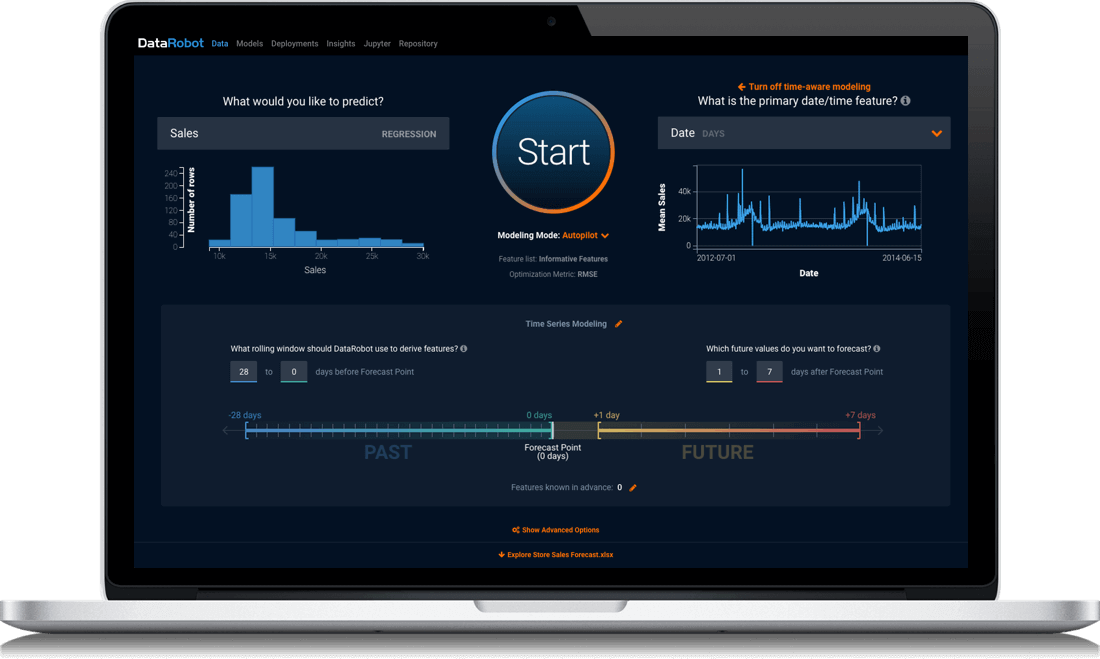

DataRobot claims to have created a version of this process that is automated, meaning rather than spending time training a model, business professionals can simply input their data and set a query for the software to answer.

DataRobots programme will then run “millions” of statistical models on it, returning only those with the lowest margin of error for users to choose from.

Neal Silbert, general manager of insurance at the company says: “Normal machine learning would be a process where you input your data, run it through one or more modelling techniques and you’re given an output — a score or prediction.

“The problem with this method is that if the result isn’t perfect — and it never is perfect — you have to go back and change your model.

“This means people spend anywhere between 60% and 80% of their time trying different variations of their data, which could also mean restructuring it so it’s on the same scale.

“Automated machine learning does a lot of this restructuring for you, allowing you to spend more time adjusting your model so you can have maybe 93% to 95% confidence in it, as opposed to 80%.”

What applications does DataRobot have for the insurance industry?

DataRobot believes the use of automated machine learning and predictive analytics is far-reaching in the world of insurance.

Actuaries tasked with setting the prices for insurance policies based on the average risk profile of customers use techniques such as the Generalised Linear Model for their estimates — but Silbert says these “20th century” methods are no longer fit for purpose.

In order to reach the 93% to 95% confidence levels in a model, he believes it needs to integrate automated machine learning.

Another benefit of using DataRobot, according to Silbert, is that when integrated with Robotic Process Automation software provided by partner company UIPath — a higher number of insurance applicants that fit an average profile can be approved automatically.

If the two softwares are embedded into the claims process too, this means that a higher percentage of claims can be approved automatically if they don’t raise red flags, and where they do, they can be escalated to human staff to check for signs of fraud.

DataRobot was an early mover in the AI and machine learning insurtech space, but CEO Achin believes the playing field is still very much open, telling Forbes that “we were early, but others have started chasing us.”