London-based insurtech start-up Reposit, an early-mover in the deposit alternative space, hopes a new partnership will expand its ability to penetrate the renters market

Insurtech start-up Reposit has partnered with rental moving specialist Tenant Shop to boost the reach of its tenancy deposit alternative among the renting and letting market.

Tenant Shop currently partners with thousands of letting agents throughout the UK, and this new agreement will give its clients the option of using Reposit as an alternative to traditional deposit schemes.

The Tenant Shop brand is owned by Inchora Ltd, a growth accelerator that also owns life insurance broker Better Protect and income protection specialist Albany Park.

Reposit CEO Jude Greer said: “We are delighted to be partnering with a company that has such a strong reputation in the market, as well as the opportunity to offer many thousands of tenants and landlords the option of using Reposit.

“Our mission is to make renting more affordable and accessible to tenants, and this partnership takes us one step closer to that goal.”

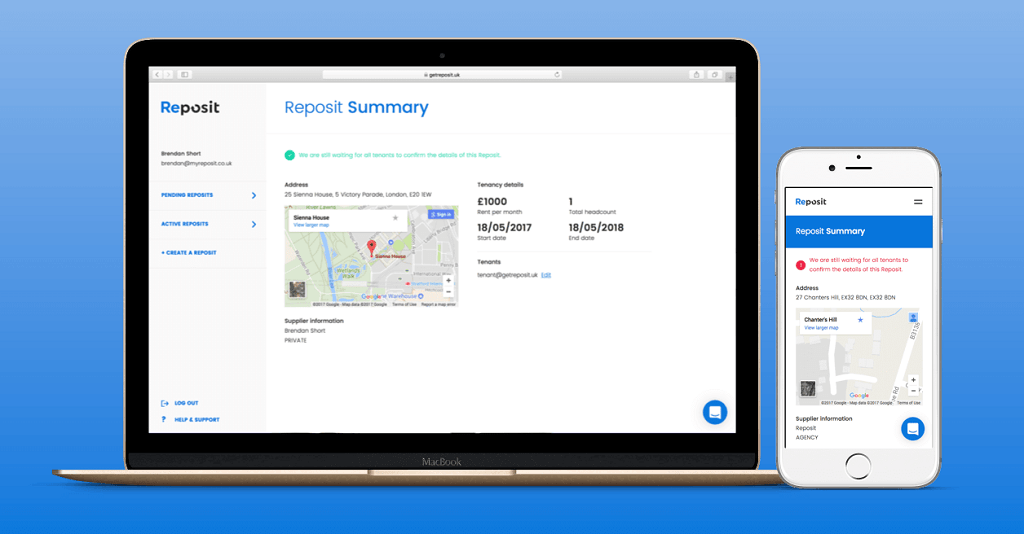

Reposit’s tenancy deposit alternative

Founded in 2015, Reposit was an early mover in the deposit alternative scene, which now includes names like ZeroDeposit, Flatfair and Dlighted.

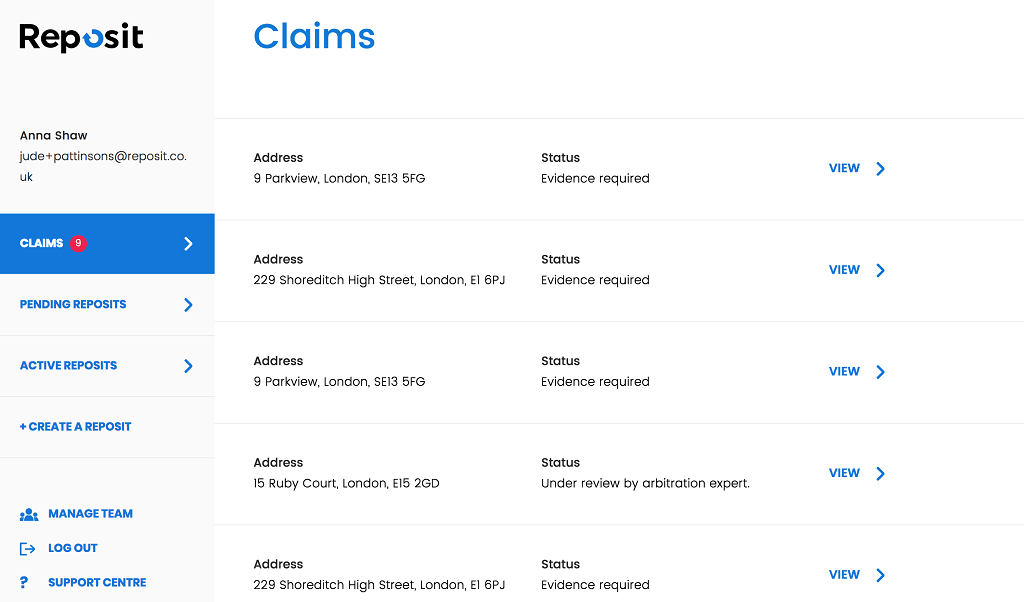

Reposit shares a similar business model with these competitors, in which tenants each pay a week of rent towards an insurance policy that makes landlords the sole recipient of any payments made as a result of a claim.

Through accepting this policy, renters give permission for Reposit and its partner Canopius – a top ten Lloyd’s of London syndicate insurer – to reimburse their landlord in the event of an insurance claim.

Tenant Shop believes its new partner offers the best deposit alternative scheme in the market, citing this as the reason it was chosen.

Managing director Glenn Seddington said: “We select our partners very carefully, taking great pride in offering our agents best-in-class solutions.

“We did a significant amount of due diligence to find the right security deposit alternative and we feel that Reposit offers the best product on the market.

“This is a key addition for us as more and more tenants look for a new way to rent property without the hassle of a deposit.

“We are delighted to offer it to landlords and tenants through our existing and new letting agent partners.”

Shared compliance standards

Parent company Inchora commended the partnership for being an appropriate fit for the company’s ethos of prioritising compliance.

Head of regulatory compliance Stewart Hinchliffe said: “We have a shared ethos, believing that compliance standards are key and that products should be properly designed to meet the needs of the customer.

“This is an insurance product protecting the landlord’s interests, and as such it is vital that the policy holder and beneficiary is the landlord and not the tenant.

“Reposit’s solution ensures that the landlord has peace of mind that they are protected, and the tenant is provided with an alternative to the traditional six weeks lump sum deposit, that is difficult for so many.”

Appealing to “generation rent”

By making renting a more affordable proposition, many of Reposit’s customers tend to be part of “generation rent”, one of many nicknames given to millennials.

Speaking to Compelo previously, Mr Greer said this was a key segment of the market it hopes to capture with its product.

He said: “We have highlighted a real problem of affordability in the rental market, and used insurance innovation to provide a solution.

“It is true to say that renting is more prolific among the younger generations, and the affordability issue is more acute within that group.

“The majority of our users are between the ages of 18 to 35 age bracket and the product is clearly most attractive within this age group.”