The World Insurance Report 2020, released today, says Covid-19 will accelerate the use of digital channels already observed across all age groups.

Authors Capgemini and Efma believe the increasing popularity of buying online has been amped up by the lockdown, meaning insurers will have to find better ways to segment the market and attract new customers.

“If age and tech-savviness are no longer consumer differentiators, will the customer preference curve be flattened? Not likely,” the report said.

“While online reviews and ratings influence around 60% of purchase decisions, about 40% of shoppers still seek input from traditional sources such as sales staff, agents and brokers.”

“Around 40% of customers are willing to pay more for a firm’s brand name, but approximately 60% prefer value for money and will buy from a lesser-known brand.

“That’s why it is essential for insurers to determine policyholders’ distinguishing characteristics, beyond tech-savviness, to segment accordingly, and to more fully understand the dynamics of the customer base.”

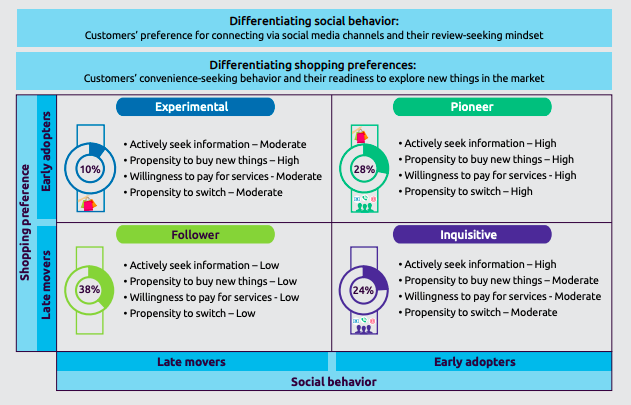

The authors suggested social media behaviour and shopping preferences define what behaviours consumers exhibit when buying insurance, separating them into the four categories below: