Several giants in the world of Irish motor insurance have agreed to pay back some of the premium paid by customers while driving restrictions apply

The Republic of Ireland's main insurance association says the premium relief will reflect each individual insurer's claim experience (Credit: PixaBay)

Some of the largest insurance companies in the Republic of Ireland will return a portion of Irish drivers’ motor premium as they are forced off the road by Covid-19 restrictions.

Global giants Allianz, AXA, RSA and Zurich have all announced commitments to give premium relief, alongside Ireland-only insurer FBD (formerly Farmer Business Developments).

The move comes after the country’s finance minister Paschal Donohoe urged companies to be “pro-active and generous” to their policyholders during the pandemic, pointing to the fact the motor sector enjoyed a profitable year in 2019 and is likely to benefit from reduced claims as fewer people are on the roads.

Moyagh Murdock, CEO of Insurance Ireland — the country’s main industry association — said: “We are now six weeks into the Covid-19 restrictions on movement and it is clear that road usage levels have fallen significantly.

“While the duration of these restrictions is still uncertain and it is still too early to fully assess the financial impact on the motor insurance sector, but recognising the unique challenges in the Irish market, insurers have agreed to address the issue by signing up to a set of core principles.”

The principles include passing on a degree of savings as premium relief through a “rebate” or “refund” — but the industry representative added that the precise amount will differ per insurer, based on their individual claims experience.

Also, if the Covid-19 restrictions on movement result in sustained lower road usage and claims frequency through the summer and beyond, insurers have agreed to further review the situation.

Donohoe calls the move an ‘important step’ but wants it implemented quickly

Finance minister Donohoe referenced his interaction with Insurance Ireland last week, in which he made the initial call for a rebate, praising the association and relevant providers for coming up with the commitment.

“In my recent engagement with Insurance Ireland, I had called upon their members to act on motor premium to reflect the new realities of Covid19,” he said.

“I wish to acknowledge today, that a number of the leading motor insurers in the Irish market have today signed up to commitments on premium reliefs for motor customers.”

“This is an important step by the sector and I also appreciate that these insurers will keep the matter under review to see how best they can serve the needs of their customers.

He also noted the need for the insurers to quickly work out the scale of their premium relief measures, suggesting they need to consider long-term goals of retaining customers by being generous.

“Obviously, it is for each insurer to look at its own situation and customer base, but I stress the importance for them to take a longer-term perspective and be generous with their customers at this time, reflecting the recent profitability of the motor insurance market,” he added.

How profitable was the Irish motor insurance market in the past 12 months?

One of Donohoe’s considerations in calling on insurers to give their customers premium relief was the fact that, according to data from the Central Bank of Ireland, the sector has enjoyed savings through a reduction in the cost of claims.

Despite this, the cost of premiums has gone up by 42% on average since 2009.

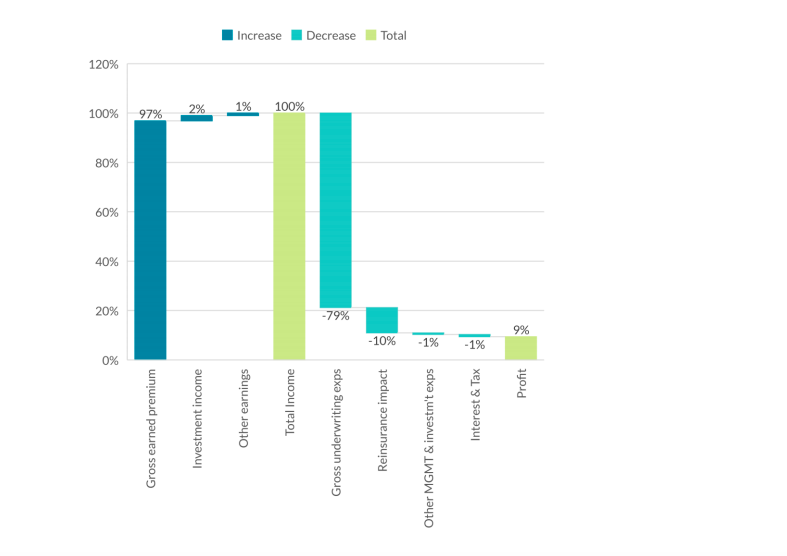

After paying out 79% of its revenue to settle claims and cover other underwriting expenses, and a further 12% spent mostly on reinsurance premium, the sector was left with an overall profit of 9% in 2018 — a figure Donohoe called “very profitable”.