Several insurance-specific upgrades have been added to the Salesforce Financial Services Cloud product — with some made possible through acquisitions

Salesforce showcased its new insurance product at Insurtech Connect 2019 (Credit: Salesforce)

Software giant Salesforce has released the first expansions to its Financial Services Cloud product designed specifically for the insurance industry.

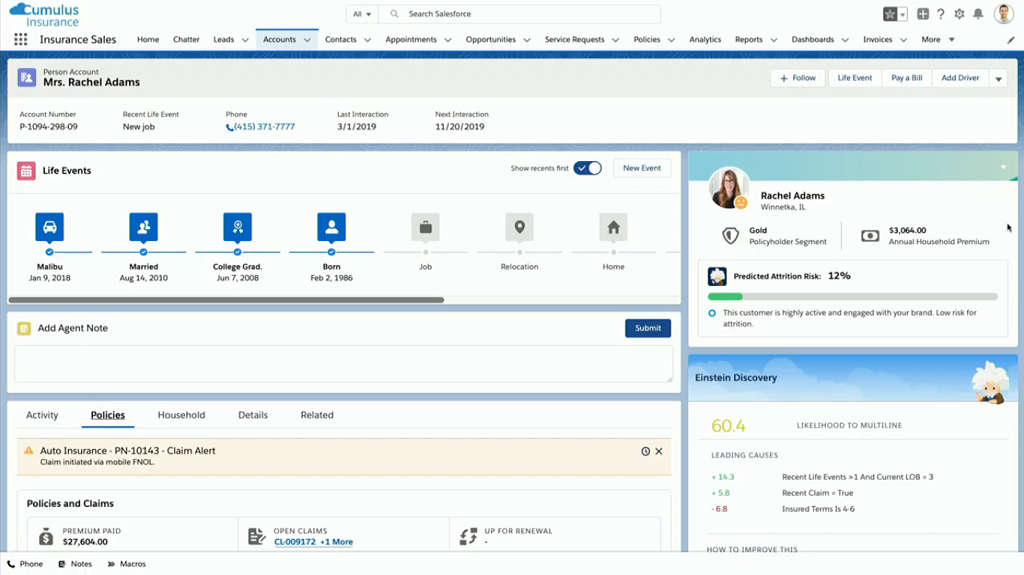

The platform now integrates several technologies and AI capabilities to provide insurance companies with what the firm calls a “360-degree view” of its customers.

The announcement was made yesterday at Insurtech Connect 2019 — an annual insurance technology conference held in Las Vegas.

Salesforce global head of insurance Ayan Sarkar said: “Now, more than ever before, the insurance industry is working towards delivering more relevant and engaging experiences at every stage of a customer’s life.

“By leveraging data and AI, and digitising touchpoints, we can now help insurers deliver distinctive experiences.

“We’re thrilled to partner with insurers on this journey to transform the industry with new insurance innovations for Financial Services Cloud.”

How does Salesforce Financial Services Cloud enhance the insurance process?

Salesforce made its Einstein Analytics product available to businesses in September 2016 — but yesterday marks the first time it’s been made available to insurance firms.

The AI-driven software extracts value from the customer data insurers hold, giving them a wider view of where they can expect customer churn to occur and where there are opportunities to upsell to customers.

In practice, this means agents and advisers can input information about the lives of policyholders, gleaned through communicating with them, and the software will analyse it against data collected on other customers in similar situations.

Based on how these other customers have acted, the software can recommend a course of action, like contacting a policyholder to upgrade their insurance plan, or simply telling the insurer how likely they are to cancel their policy and look elsewhere.

Salesforce also claimed its Community Cloud product — a set of pre-built templates to link insurers to their distribution partners — could allow for “permissions-driven sharing of data across financial services organisations”.

New insurance functionalities made available after acquisitions

Salesforce is known for providing an impressive array of tools to monitor and maximise selling within a company, but to launch its insurance-specific product, it made several acquisitions of smaller technology start-ups.

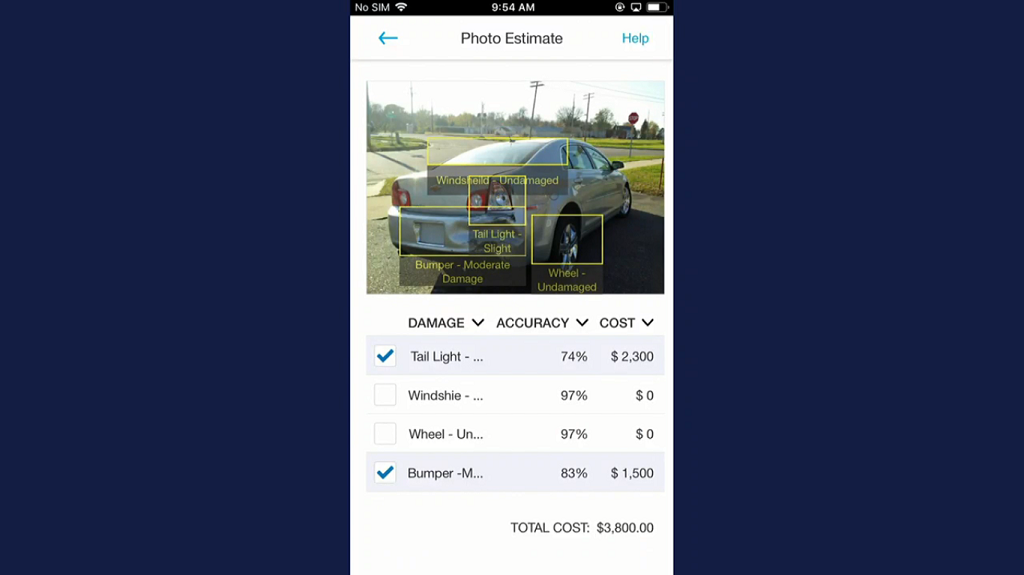

During its launch event at Insurtech Connect 2019, Salesforce showcased its technology in a fictional scenario where one of its policyholders had a car crash, and displayed an AI-driven image recognition programme built into an app that could provide pricing information for car parts damaged in the collision.

This functionality was made possible by the company acquiring computer vision software start-up MetaMind in 2016.

Salesforce senior vice-president of product management for its cloud-based products, Rob Seaman, came on stage to talk the audience through what happens on the insurance agent’s screen once a claim is lodged, and made reference to Mulesoft Anypoint — a software that allows programmes to extract data from legacy systems.

Mulesoft was acquired by Salesforce in May 2018, and has this functionality to allow the Financial Services Cloud to extract data on policyholders held on other programmes automatically, feeding it into Einstein Analytics to gain insights.