PZU implemented AI solutions after detailed review of nearly 20% of its motor claims handled by body shops

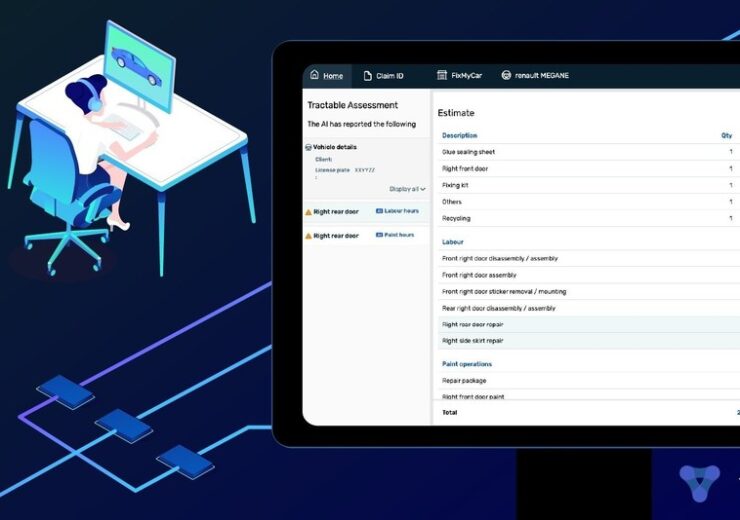

PZU is first Polish insurer to use AI to analyse auto damage using Tractable. (Credit: Tractable.)

Polish insurance firm Powszechny Zakład Ubezpieczeń (PZU) has deployed AI solutions offered by the technology firm Tractable to enhance the review of car insurance claims in the country.

Tractable develops AI systems for accident and disaster recovery, which have been deployed by insurers across Europe, North America and Asia.

PZU implemented AI, after detailed review of nearly 20% of its motor claims handled by body shops. The AI solutions are designed to enable the company clearly check all of the body shop claims in real-time.

The AI solution offered by Tractable leverages machine learning algorithms and is trained on photos and human repair decisions across millions of historical accidents.

The algorithms are designed to detect anomalies that require attention of PZU’s experts or confirmation of compliance with procedures and standards defined by PZU.

PZU innovation lab director Marcin Kurczab said: “At PZU, we strongly believe in cooperation with top insurtech startups to transform our business. I am pleased that together with Tractable, we have implemented innovative computer vision technology.

“Now, we are able to better control our cooperation with body shops and resolve any anomalies in a much more efficient way than ever before.

“We are pleased not only with the success of the project, but also with the fact that, as the first insurer in Poland, we have implemented this unique technology on such a scale in cooperation with a leading UK tech company.”

PZU said that the current partnership with Tractable is built on previous relationship since 2018, and is the first insurer in Poland to use AI to process the motor insurance claims.

The AI solution is said to help insurers assess car damage, shares recommended repair operations, and guides the claims management process to ensure rapid processing.

Furthermore, the technology has handled more than 150,000 claims, which constitute one third of the company’s annual auto claims volume, worth PLN1.3bn($346m).

Tractable co-founder and president Adrien Cohen said: “It’s been incredible to see how PZU, one of the most respected companies in Poland, has deployed our cutting-edge solution on a large scale.

“This proves PZU’s dedication to innovation and placing it amongst the most advanced insurers in the world. Our solution gives PZU control over 100% of its repairs and claims, all in real time, thanks to the speed and reach of AI.”