Pyramid Solutions has launched a new version of its Life Underwriting Solution to include cognitive capture and advanced analytics capabilities.

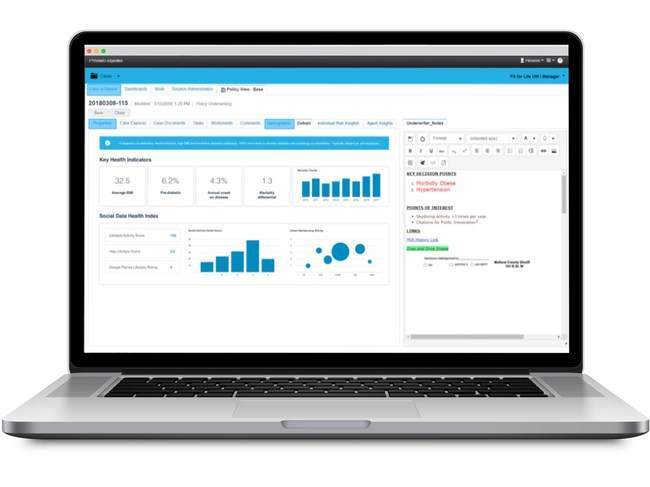

Image: Pyramid Solutions releases new version of life underwriting solution. Photo: courtesy of Pyramid Solutions, Inc.

The Life Underwriting Solution is used to complement and facilitate a life insurance provider’s accelerated underwriting program. It significantly reduces the time it takes to process an application, increasing overall productivity, efficiency and customer satisfaction.

Challenges it Addresses

Pyramid Solutions Insurance principal Will Sellenraad said: “There are a lot of things going against life insurers – a growing (and changing) millennial market, increasingly complicated life policies and an expanding knowledge and talent gap just to name a few.

“These challenges make it difficult for underwriters to quickly make decisions, so we see more and more carriers turn to their IT department or manual processes to address their needs.”

Although an option, relying on the IT department or implementing manual workarounds are not sustainable solutions. To remain relevant in the industry, life insurers and reinsurers are investing in their legacy and obsolete technology and processes and implementing accelerated underwriting programs.

How the Life Underwriting Solution Works

The Life Underwriting Solution is a comprehensive accelerated underwriting solution that leverages the latest in case management, cognitive capture, advanced analytics and workflow technology to reduce the time it takes to process a policy application.

After applying cognitive capture to structured and unstructured/complex documents, the Solution classifies the data as a number, a prescription, a doctor’s note, handwriting, and more as it can interpret the context around the data.

Pyramid Solutions product manager Bill Rachilla said: “What’s so visionary about the Life Underwriting Solution is how it applies case management functionality to the cognitively captured data.

“Because after it captures only relevant data, it applies workflows, rules and analytics to alleviate one of the biggest pains that underwriters experience – flipping through page after page looking for risky information.”

The Pyramid Solutions Life Underwriting Solution automatically bookmarks any data related to cancer, heart disease and diabetes. As the system captures the data, any instance or data related to these three leading causes of death is flagged and added to a menu for the underwriter to click on and learn more.

As opposed to flipping back and forth between document pages and manually documenting cancer-related data, the Solution extracts all of that for the underwriter. In addition, it displays extracted data in relevant charts such as a timeline showing overlapping diagnoses or a scatter plot charting vitals over the years.

Rachilla said: “What our clients are most excited about with the Life Underwriting Solution is the analytics.

“Because of this capability, our Life Underwriting Solution can provide underwriters with insights to make predictable and consistent policy ratings and review risk scores.”

By combining all these technologies together, underwriters can fast-track decisions. They can easily see an applicant’s ailments, if they’ve had any diagnoses of cancer, heart disease or diabetes and make decisions on their policy application quickly.

Source: Company Press Release