Customer expectations are at the forefront of insurers' minds as they become more about speed, but an Aegon exec believes the claims process is the most important step to get right

The claims process is the “moment of truth” for insurance companies, and artifcial intelligence technology can make it a positive experience, according to an industry leader.

Insurance firm Aegon’s head of corporate development Marc van Weede said AI could improve the claims process by making it more efficient for customers.

Speaking at the Innovate Finance Global Summit in London today (29 April), he said: “Technology is playing a big role across nearly all steps in our value chain.

“Claims management is an area where AI and powered algorithms are actually helping to make the whole claims process smoother.

“Claims really are the moment of truth for an insurer, so anything we can do to make that as painless as possible is a great benefit.”

Why insurance claims process is most important part of customer experience

In an interview with Compelo after his presentation, Mr Weede elaborated on why the claims process is so crucial.

He said: “With an insurance company, and particularly a life insurance company, usually the first interaction for customers is when they actually buy a product.

“But the next interaction, when they make a claim, is usually the beneficial step where all those years of paying a premium have to translate into delivery of service – for that reason, it is the moment of truth.

“Insurtechs can make the whole process smoother because the more of the claims management process that can be transacted automatically, the better the customer experience is.”

How Aegon is using insurtech technology

Like many other insurance companies, Aegon is integrating automation software into its business processes to make them more efficient.

In his presentation, Mr Weede said: “We’re working with companies to robotise our manual processes – companies like Automation Anywhere and Blueprism – to take these manual steps out of these legacy processes that we have and probably will still have for many years.”

But the firm is also making use of a $140m (£108m) venture capital fund to invest in insurtechs with technologies that are relevant to its business.

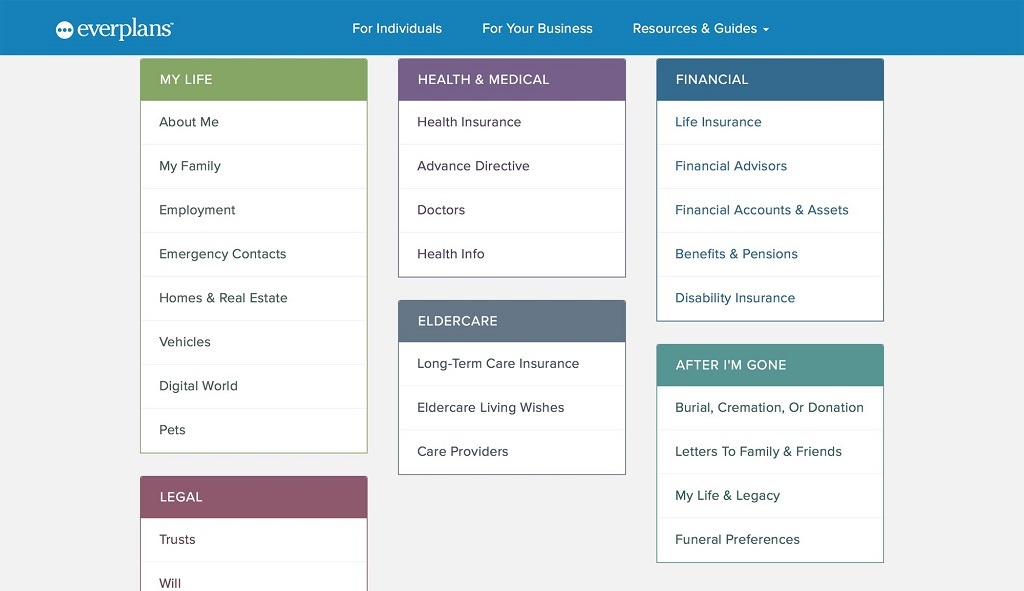

One firm the fund has invested in is Everplans, a company that created an interactive storage facility for important documents needed in the event of a life insurance claim.

Mr Weede added: “An ‘everplan’ is a place where you can store everything that your loved ones will need should you not be there anymore.

“It’s a digitally secure vault where you can store passwords, your will and your funeral wishes, which you can share with people you designate.

“Transamerica, our US company, actually uses it through their brokers to help them engage with customers.

“It’s a great way to strengthen the customer relationship, and also a good way for brokers to create a relationship with the next generation.”

Insurance claims technology can reduce fraud

Mr Weede admitted fraud was a big part of the insurance industry but added that AI could also help to identify criminal cases.

His sentiments were echoed by Blair Turnbull, managing director of digital and retail for multinational insurer Aviva, who believes technology is having a key role in the fight to eradicate a huge problem for Britain’s insurance industry.

He told the conference: “At claims time, it can feel like you’re being tortured, because you’re trying to explain something that happened to you in the moment.

“For an insurer in the UK, where 50% of all claims have an element of fraud, how do you make sure again that you don’t go bankrupt by paying all of the bad ones?”

Mr Turnbull referenced how Aviva has added dash cam functionality to its Aviva Drive app as an example of how technology can help reduce claims.

Dash cam footage can act as video evidence that can clearly prove who was at fault and help to explain any unexplainable circumstances to their insurer.