Motor sector disruptor honcho plans to use the injection of cash to add marketplaces for consumers to buy two additional insurance types

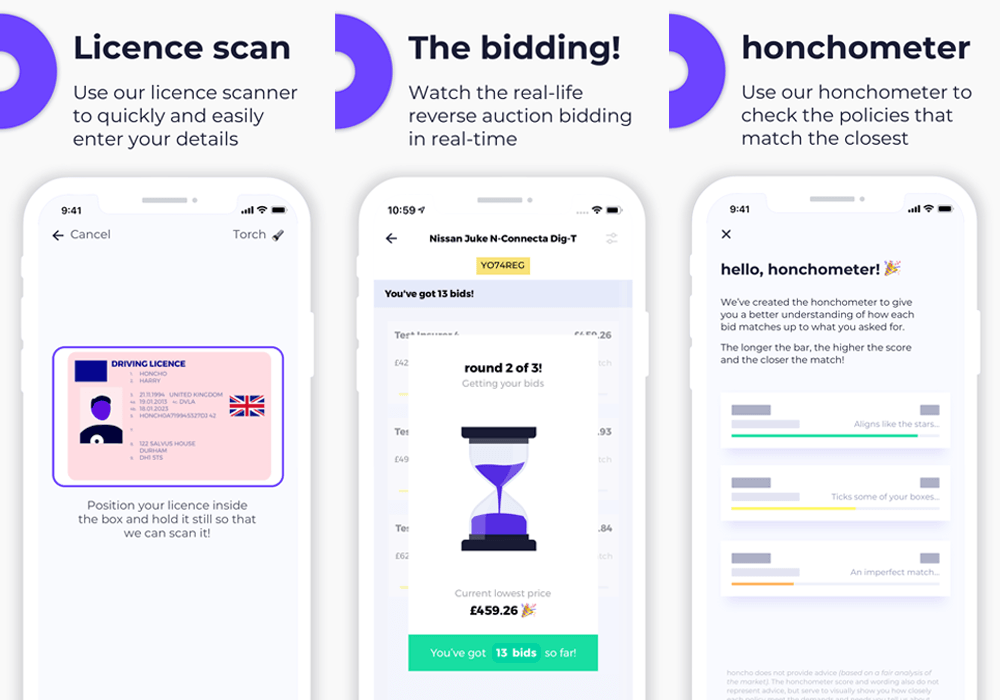

The honcho app allows users to pick from a range of policies (Credit: honcho)

Motor insurance technology start-up honcho has received a £1.2m ($1.5m) investment boost after closing its latest funding round, bringing its total backing to £3.6m ($4.5m).

Contributors included existing investor Durham Finance, a debt and equity funding group set up by Durham County Council and managed by Maven Capital Partners, crowdsource investors, and specialist venture capital firm Insurtech Gateway.

Alongside the investment, the company also announced plans to add a marketplace for van owners to its app during this spring, followed by one for learner drivers looking for cover.

CEO of honcho Gavin Sewell said: “Raising investment is one of the most challenging aspects of running a startup, and we’re delighted to have achieved this £1.2m raise with the continued support of Maven and with further investment from the crowd.

“We’re also thrilled to welcome Insurtech Gateway to the honcho family. As specialists in our sector they will bring an immense amount of support to honcho as we enter our next phase of growth.

“Insurtech Gateway’s expertise across the sector extends from technological capabilities to expertise on products and consumer acquisition, and we’re looking forward to working with them.”

Among the portfolio of companies that have benefited from Insurtech Gateway’s position as a funder and incubator of start-ups are pay-per-mile insurer By Miles and parametric flood cover provider FloodFlash.

Insurtech Gateway CEO Richard Chattock said: “Today’s consumers rightly demand fairer, more transparent insurance and honcho’s new model delivers this.

“It reduces commissions, eliminates bias and allows consumers to make purchasing decisions on product as well as price.

“We’re delighted to be joining honcho’s journey to revolutionising personal lines insurance distribution.”

Plans for honcho to launch motor insurance marketplace for vans and learner drivers

Since it launched an app-based marketplace for car insurance in autumn 2019, honcho claims “thousands of consumers” have signed up, and 12 insurance providers are now active on the platform, selling policies from 30 underwriters, including Axa, Aviva, Ageas and Zurich.

The start-up’s plans for expansion in 2020 include the launch of a marketplace for van insurance, and following that, one for learner drivers to get cover, both using the same “reverse auction” style model.

Chief product officer Tom Spence said: “There are over four million vans on the UK’s roads and the nation’s van drivers have been at the mercy of price comparison websites for their insurance for far too long.

“honcho’s van insurance marketplace will launch this spring and we’ll be bringing long-overdue transparency and fairness from some of the UK’s leading van insurance providers.

“Following van insurance, we’ll be extending honcho to learner drivers. When you’re learning to drive the last thing you need is to navigate the mysterious maze of learner insurance to then get lumbered with something that isn’t right for you.

“honcho is going to change all of this with our special learner zone in the spring, bringing our unique reverse auction marketplace to both temporary and annual learner driver insurance.”