Getsafe has partnered with insurance industry giant Hiscox, which will underwrite its newly launched contents insurance targeted at millennial renters

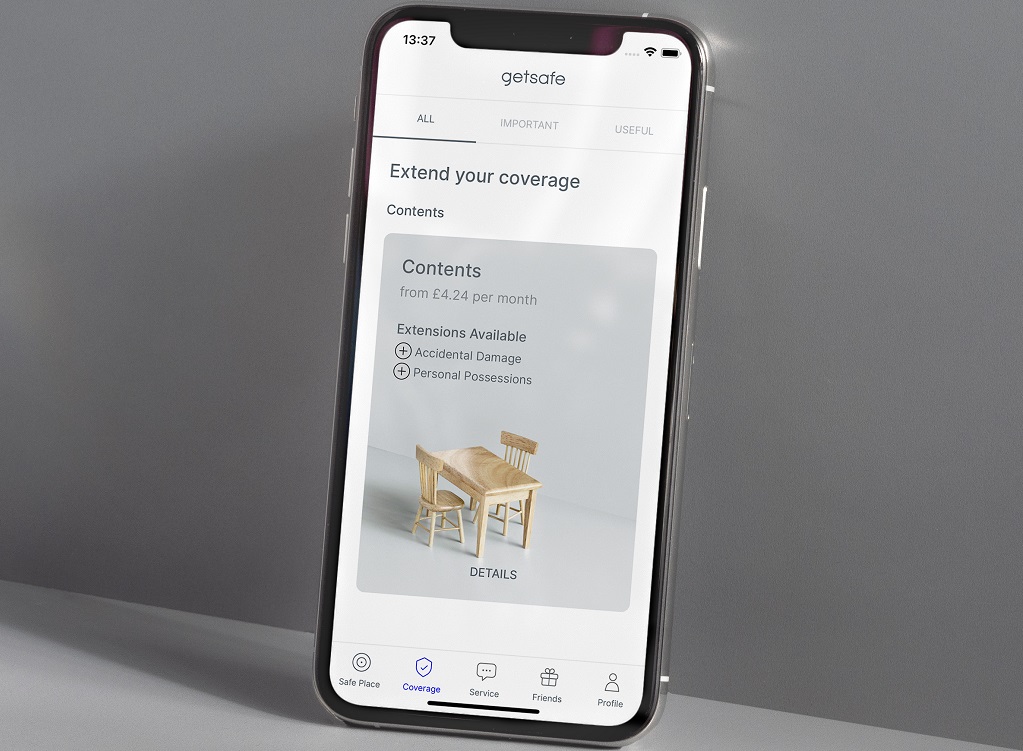

GetSafe will operate its renters' contents insurance through its smartphone app (Credit: Friedemann Hertrampf, GetSafe)

German insurtech start-up Getsafe has entered the UK market with a renters’ contents insurance product underwritten by industry giant Hiscox.

The company claimed more than 80,000 active insurance policies in its native Germany in October 2019, according to a blog post on its website, and it now plans to expand with a goal to serve the whole of Europe.

The firm cited higher levels of “digital affinity” among younger consumers than in Germany as one reason for choosing the UK as its next market, stating that it wishes to become a neo-insurance company operating on the same scale as neo-banks such as Monzo and Starling.

CEO and co-founder Christian Wiens said: “Over the last two years, we have shown that our product meets a core need for the young, tech-savvy generation.

“With our insurance delivered through your smartphone, we are developing a product that fits perfectly with the living and communication habits of this generation.

According to data from market research company eMarketer, the UK is the largest market in Europe for business-to-consumer e-commerce sales, with a total value of €165bn made in 2018 ($183bn), compared with second-place Germany’s €98bn ($109bn).

Getsafe believes neo-banks in the UK have proven that its target market of young consumers aged between 20 and 35 are particularly open to using smartphones to conduct financial activity, but the insurance industry is yet to replicate their success.

“With our smartphone app, Getsafe will close this gap in the market,” Wiens adds.

Renters’ contents insurance is currently the only insurance product available through the start-up, but it said it will look to introduce more coverage types “very soon”.

App engagement a key part of Getsafe strategy

From the beginning of its journey, Getsafe has been focused on increasing engagement within its app, believing it to be a key reason for the success of the neo-banks that inspire it.

The start-up is an intermediary within the insurance process known as a managing general agent — a middle man that connects insurance seekers with underwriters and capacity.

“Getsafe acts as a platform with multiple carriers, including Munich Re and AXA, providing the capacity in the background,” explains Wiens.

“With Hiscox, we have a renowned carrier for our UK contents product at our side and are pleased to be working with them.”

The same blog post that revealed its customer base late last year also stated that 35% of its users in Germany returned to the app every month to purchase or manage their policies.

“At the moment, we are particularly proud that our customers use our app intensively,” he adds.

“More than a third of them return to our app every month to get information and to organise and protect what is most important to them in life.

“Such a high level of engagement has never been seen before in the insurance industry. We can now offer that to UK customers as well.”

Getsafe also announced that the first fully-digital life insurance policy for German customers will follow this year.