Insurtech firm Digital Risks has raised £2.5m investment to simplify insurance for fast-growth tech and media businesses.

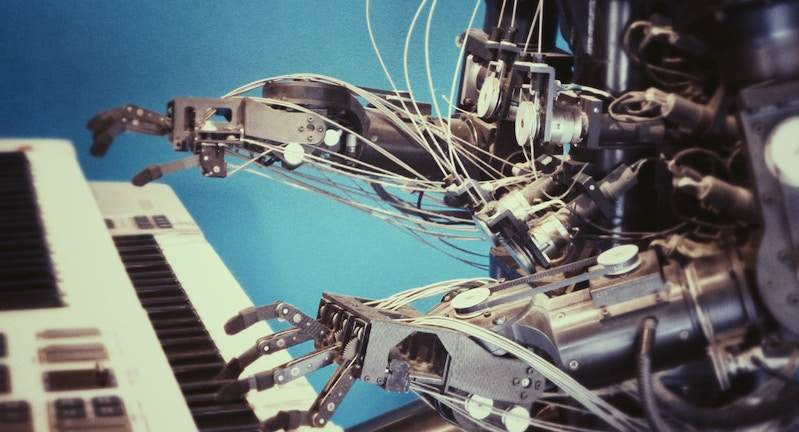

Image: Digital Risks secures £2.5m funding. Photo: Courtesy of Digital Risks.

Concentric led the investment round, which saw participation from Atami Capital, Seedcamp, London Co-Investment Fund and Beazley.

Digital Risks, which was co-founded Cameron Shearer and Ben Rose, offers online insurance coverage with flexible monthly subscription model, which is claimed to be ideally suited for today’s millennial run, digital-first businesses.

Shearer and Rose worked together to build a new type of insurance brand that would make buying insurance easy and accessible for digital SMEs.

Digital Risks is planning to tap into the booming digital start-up and SME market. The company already provides insurance services to several of UK’s top start-ups, across sectors spanning software development and IT services, media, digitised traditional businesses, plus new technology sub-sectors like fintech, medtech and edutech.

The funding will be used by Digital Risks to grow its business, through scaling its marketing, tripling its team and developing new online insurance products. The company is also planning to expand internationally, by expanding across Europe in the next 12 months.

As per the company, the UK’s digital industries are growing 32% faster than any other part of the economy and it represents 1.9 million businesses in the UK, with an anticipated growth of 5% each year.

To cater to the start-up market, Digital Risks has developed its own software that automates the entire process of buying and managing insurance. Rather than providing price comparison service or consolidating customers’ risks to a single underwriter, the platform claims to consider the risks individually and places them with the most suitable provider.

This system is similar to a traditional offline broker process, but it is sold entirely online and as a single experience.

The firm’s services are subscription-based and they can be modified or cancelled at any time, which offers greater affordability and accessibility to growing businesses. Its products are backed by underwriters, including Aviva, Tokio Marine and Beazley.

Digital Risks CEO and co-founder Cameron Shearer said: “The digital industries are growing at a phenomenal rate, as new technologies spark disruption across practically every business sector. Yet the commercial insurance industry has been characteristically slow to respond, leaving many tech startups and SMEs unable to protect themselves adequately.

“The industry needs to evolve in so many ways, from product design, to distribution and customer engagement. There’s also a lack of understanding of emerging technologies, the risks involved and how to cover them, particularly with the rise in online threats, such as data breaches and social engineering.