GlobalData expects take-up of private medical insurance in China to increase, fuelled by growing trust in the sector after its reaction to coronavirus

The coronavirus death toll has risen to more than 1,000 people in China (Credit: Unsplash)

The Wuhan coronavirus outbreak is expected to increase purchases of private medical insurance in China, according to market research firm GlobalData.

As the reported death toll in the country rises to more than 1,000, according to its National Health Commission, insurers are relaxing their policy terms to extend coverage to victims.

GlobalData insurance analyst Tapas Bhowmik believes this action will increase trust in the health cover sector, and by extension lead to higher take-up of private medical protection products.

He said: “The current health crisis is expected to accelerate the shift in consumer attitudes towards private health insurance.

“An increased number of people are expected now to look to purchase private health insurance to complement their existing public health coverage.

“This presents a significant growth opportunity for private health insurers in China.”

The analyst’s view chimes with that of ratings agency AM Best, which recently predicted the mid-to-long-term impact of the virus — known in medical circles as 2019-nCoV — would be increased private medical insurance sales in China, after a short-term drop caused by containment efforts.

Ageing consumers with more wealth are driving demand for private medical insurance in China

Part of the reason GlobalData and AM Best expect to see increased uptake, is that before the virus hit, there was a growing demand for coverage in the private market for those not content to rely on the country’s state-provided health insurance, which Bhowmik described as limited.

“Rising income levels and an ageing population are driving the demand for better and higher quality healthcare services in China.

“The public healthcare system only provides limited cost coverage, forcing people to purchase private health insurance to cover the additional cost involved.”

In a recent report on the impact of the coronavirus outbreak, AM Best said the Chinese government had committed to covering the cost of treatment for victims, which would reduce the claims burden on the insurance industry.

GlobalData expects penetration rates to grow

According to GlobalData stats, the direct written premium of private health insurance in China is estimated at 618.7bn Chinese Yuan ($90.6bn) in 2019.

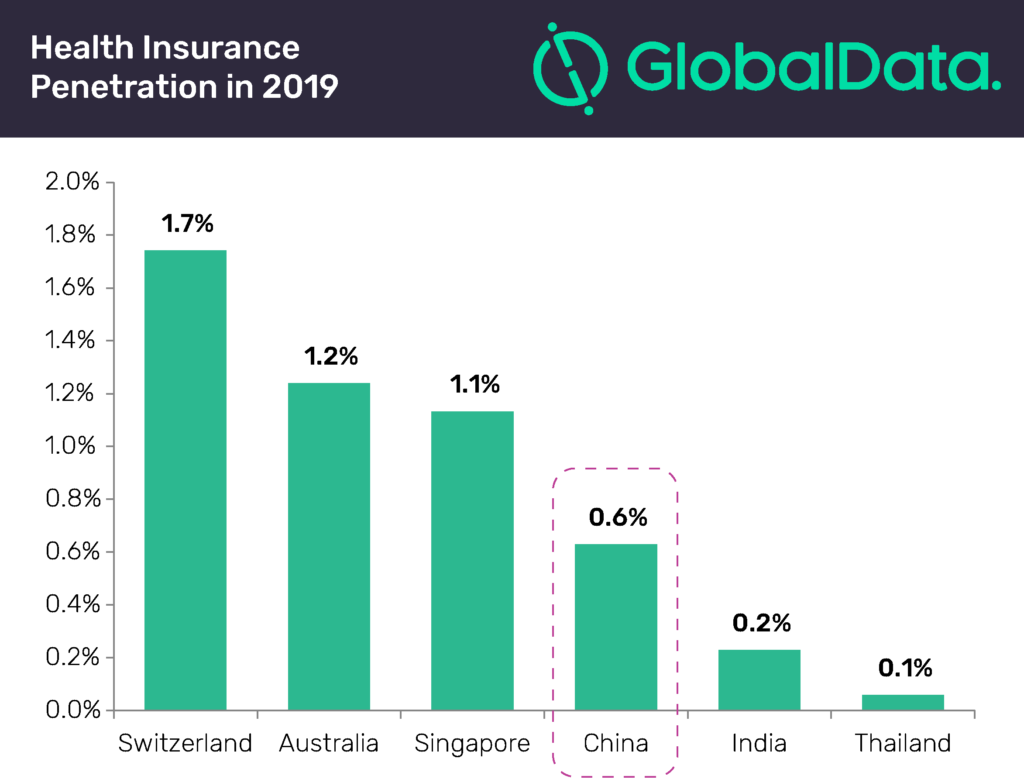

This figure represents a penetration rate of 0.6% for the sector, much less than neighbours on the Asian continent, Australia and Singapore, where rates are 1.24% and 1.13% respectively.

“Private health insurance adoption has traditionally been very low in China due to the presence of public insurance system, which covers almost 97% of the population,” explains Bhowmik.

Before the World Health Organisation designated coronavirus a public health emergency of international concern on 20 January, GlobalData predicted that China’s private medical insurance market would grow to 0.74% penetration in 2022.