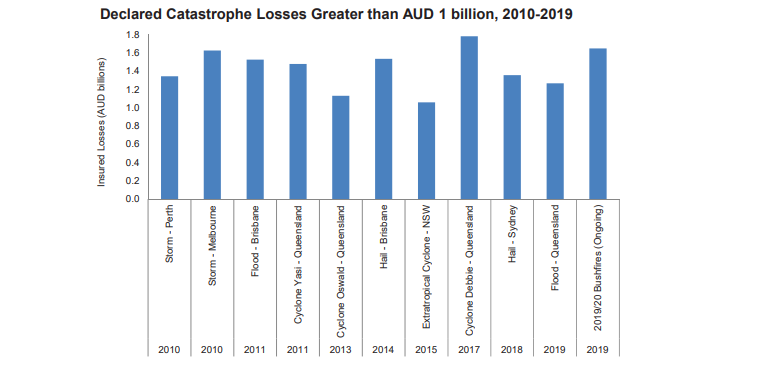

Data on losses from the Insurance Council of Australia reveals that the Australian 2019/2020 bushfire season will be one of the most costly on record

A bushfire blazes in the distance in Orroral Valley, Australia (Credit: WikiCommons/ Nick-D)

The insurance industry is able to withstand the 1.7bn Australian dollars ($1.1bn) in insurance losses caused by bushfire events, but those passing on the costs to reinsurance companies are expected to face tighter policy conditions and higher prices in the next renewal period.

These are the two main takeaways of a report from ratings agency AM Best on the bushfire losses caused by blazes across Australia’s south-eastern states that reached their worst point over the New Year period.

On January 7, the agency reported insured losses of A$700m ($472m) – but recent figures from the Insurance Council of Australia show the amount has more than doubled, and AM Best expects it to continue to rise.

The report said: “Claims activity is expected to stem from insurers’ personal lines portfolios, with over 2,800 homes and numerous outbuildings destroyed to date, as well as from commercial losses.

“Ultimate loss estimates won’t be determined for some time. However, on the expectation that reported losses will rise further, the 2019-20 bushfire season will clearly be one of the costliest on record.

“Although the overall message from Australian reinsurance renewals at 1 January 2020 has been one of general stability, meaningful bushfire losses passed to reinsurers may result in upward pressure on reinsurance rates, and tightening of terms and conditions in upcoming renewal windows.”

AM Best expects Australian bushfire losses to “dent” earnings of insurers

According to AM Best, until the extent of the insurance losses caused by Australian bushfire events can be realised, it’s unclear how much of an impact they’ll have on the full-year earnings of insurers, as well as how much they’ll need to rely on reinsurance to smooth losses

But as of now, the agency does believe a “dent” will be made in earnings – the size of which will be determined by the individual reinsurance arrangements of providers.

The report added: “As loss estimates and insurers’ exposures increase in certainty, so too will the ultimate destination of losses and the reinsurance coverages triggered.

“Individual insurers’ reinsurance terms and conditions will also play a role, particularly concerning the definition of a single event, notably concerning any geographical restrictions and hours clauses applying to the fire series.

“Determination of these terms may prove material for certain insurers in determining whether event excess of loss retentions have been reached.”

Bushfire losses may affect pricing and appetite of insurers

Although it considers Australian insurers to be well placed to deal with the mounting losses, AM Best said those companies will be “carefully considering” their future exposure to bushfire-prone areas – something that could result in higher rates and less appetite.

Part of the reason for this is that the country is experiencing a risk-narrowing process between rural areas traditionally regarded as high risk and urban areas thought not to be.

The same experience has been witnessed in California during its wildfire season.

“Bushfire is a known and annual risk in Australia,” the report added. “However, managing changes in climate conditions presents a real risk for insurers and reinsurers, particularly as certain areas consumed in the current blazes were previously considered low-risk bushfire zones.”