ActiveQuote's head of partnerships explains how the personal protection priorities of consumers shifted during the pandemic, revealing a greater emphasis on the need to safeguard incomes and use health insurance to avoid NHS waiting times

Personal protection insurance products fall into the categories of life, health and income protection cover (Credit: PxHere)

The coronavirus pandemic and resulting death toll of Covid-19 has forced many within the UK to face the prospect of their own mortality, and new statistics from ActiveQuote suggest this is changing the priorities that drive their personal protection insurance shopping habits.

Personal protection products is the umbrella term for life, health and income protection insurance, and the broker and price comparison website has been tracking these changes through the UK lockdown period.

In this Q&A, ActiveQuote head of partnerships Rod Jones gives some insight into how consumer priorities have changed.

Q: Where would demand usually be for personal protection insurance products at this time of year?

Usually at this time of year, all enquiries go down, because the market tends to be quieter during the summer months.

It tends to be really busy in January, dip down in the Easter holidays and then pick back up after September.

This year the enquiries are increasing and it’s been completely different.

Q: What happened to demand for personal protection products in the lead up to the Covid-19 lockdown?

During the weeks leading up to lockdown in the UK, consumer behaviour towards personal protection changed dramatically.

Income protection has not been a mainstream product like life insurance in the UK, however, Covid-19 made consumers think what would I do if I was off sick for a long period of time, and how would I pay my bills if I lost my job?

This is especially concerning for private-sector workers with minimal company sick pay.

In truth, these questions have always been there, but Covid-19 made them incredibly real.

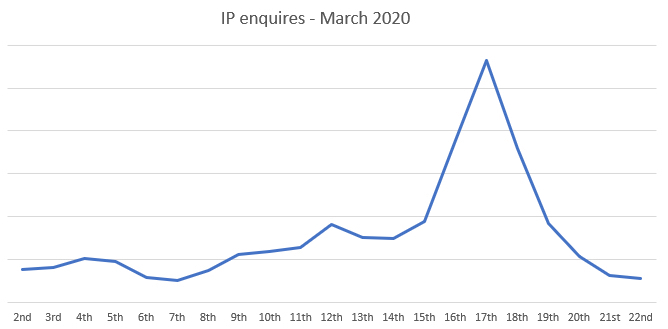

ActiveQuote.com (who provide income protection services for Moneysupermarket, GoCompare, Confused, uSwitch and money.co.uk) saw an uplift in enquires for income protection of 1190% over the 5 week period between Feb 18 and March 17.

On March 17 we had nearly 6,000 enquiries in one day, before that we were averaging a few hundred enquiries a day.

Q: What’s happened to demand for income protection since lockdown?

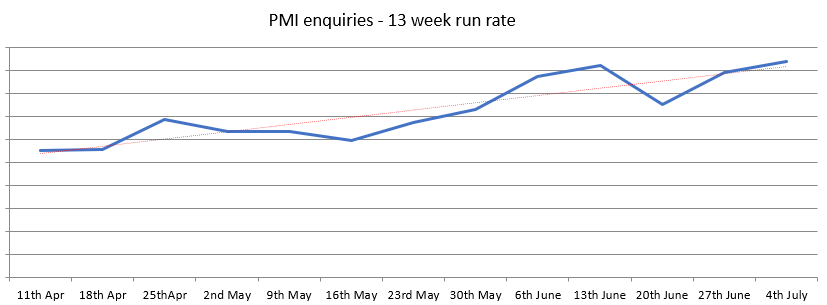

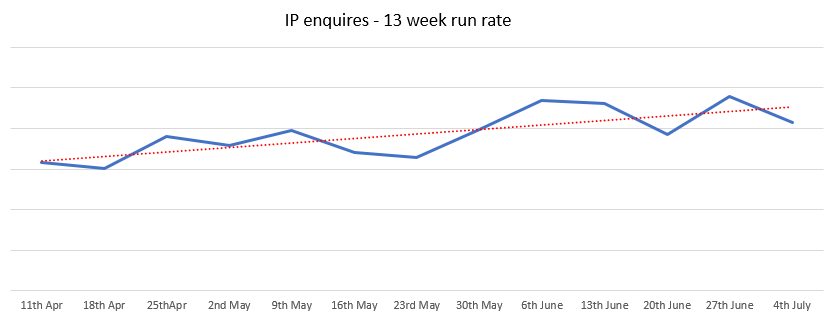

After lockdown started on March 23 the demand for income protection fell, but we are now seeing demand increase again, with a 31% uplift during the past 13 weeks.

However, insurers are no longer offering unemployment cover, which is one of the main drivers for income protection during the current climate.

After speaking to some insurers, it seems unlikely any unemployment insurance products will return to the market until the furlough period has ended, or more realistically until 2021.

Q: Is there an average age profile of those enquiring about income protection insurance?

Income protection has traditionally been something consumers in their early 40s look to consider, but since the pandemic hit in early March the average profile of enquirers has been edging closer to the mid-30s.

The average age of those seeking income protection cover through ActiveQuote dipped more sharply in March than across the entire 14-month period leading up to it.

It then rose again slightly from age 36 to 37 in April, which is still two years younger than the average customer approaching the site for the same reason back in April 2019.

Enquiries via the ActiveQuote site from those under 25 also rose by more than 400%, by more than 300% from those under 30, and by more than 250% among those under 35 in March 2020, compared to the same time last year.

Signs the crisis is already beginning to affect a new post-Covid generation of employees are beginning to emerge too, after the number of enquiries from customers aged 20 and under also rose five-fold in the same period.

Q: What has happened to demand for health insurance and life insurance since lockdown?

Consumers seem to be taking personal protection a lot more seriously since lockdown, with life insurance enquires up 47% over the past 13 weeks, and health insurance enquiries up 70% during the same period.

The demand for health insurance is expected to continue to increase, as the public becomes increasingly concerned with the knock-on effect Covid-19 is having on NHS waiting lists.