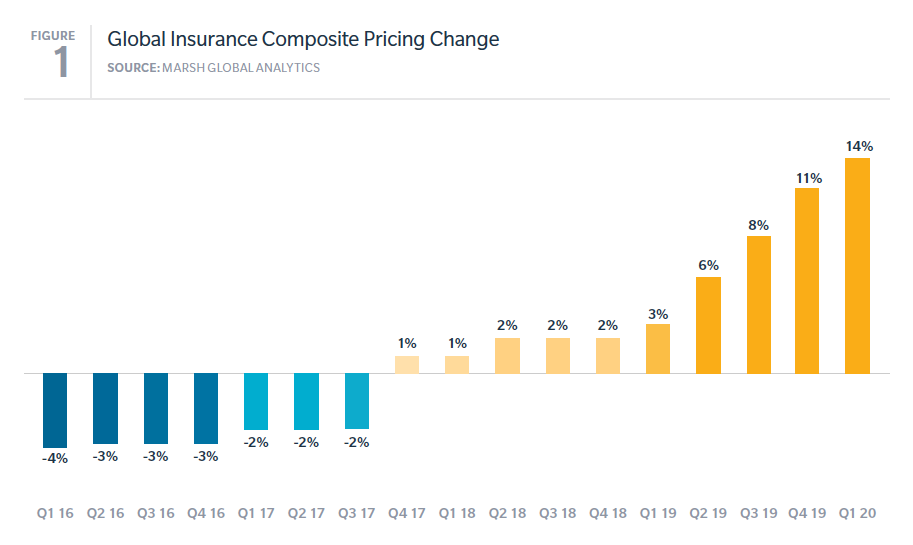

The world saw a 14% overall increase in the price of commercial insurance in Q1, but Marsh believes Covid-19 will drive further jumps in 2020

The price of commercial insurance has risen dramatically in some areas of the world (Credit: PxHere)

Marsh expects the global price of commercial insurance to continue on an already upward trend in 2020, fuelled by the impact of Covid-19.

Global commercial insurance prices rose 14% in the first quarter of 2020, marking the tenth consecutive quarter of price increases.

The figures were given in Marsh’s Q1 Global Insurance Market Index, alongside comments suggesting the first-quarter impact of Covid-19 had been insignificant for prices.

Dean Klisura, president of global placement and advisory services at Marsh, said: “Pricing was trending higher in the first quarter, prior to any meaningful impact from losses associated with Covid-19.

“We do expect, however, that Covid-19 will have a meaningful impact on pricing for the balance of 2020.”

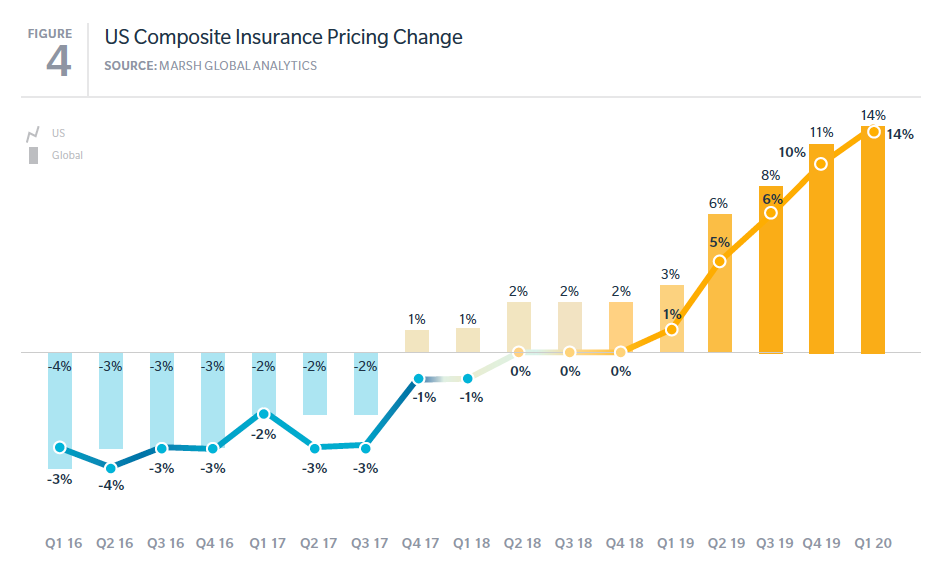

US commercial insurance price increase

Marsh’s index found a 21% market-wide jump in pricing for US commercial property cover, compared to an average of 15% seen across the globe.

The firm highlighted that the figure was the highest increase to the coverage line it had recorded since it began running the index in 2012.

But the highest increase was observed in financial and professional liability coverage, in which a 23% rise was driven mostly by directors and officers liability insurance – which had a 44% increase in price.

Marsh said the increase in premium, which affected 95% of consumers, was due to increased litigation, especially from investors that felt the price of their stock reduced due to fraudulent manipulation or other violations of federal or state securities law.

Despite these increases, the overall price change for US commercial policies was 14%.

UK and Continental Europe

The UK experienced the second-largest increase in commercial insurance pricing, at 21%, just behind the Pacific region – which recorded a 23% increase driven by catastrophes in New Zealand and Australia.

While the whole of Continental Europe – a regional category that excludes the continent’s surrounding islands – recorded an 8% increase, in the UK the figure was 21%.

Much like the US, Marsh found the increase was driven in large part by a big increase (46%) in the price of directors and officers liability insurance.

But the index also reported a 10% increase in the cost of commercial property cover, and a 5% increase in the commercial casualty line.

Marsh recorded a 6% price increase in Latin America and Asia.