The global insurance rating agency has called on relevant insurance companies in the US to submit their potential losses, adjusted to include national and regional assistance programmes

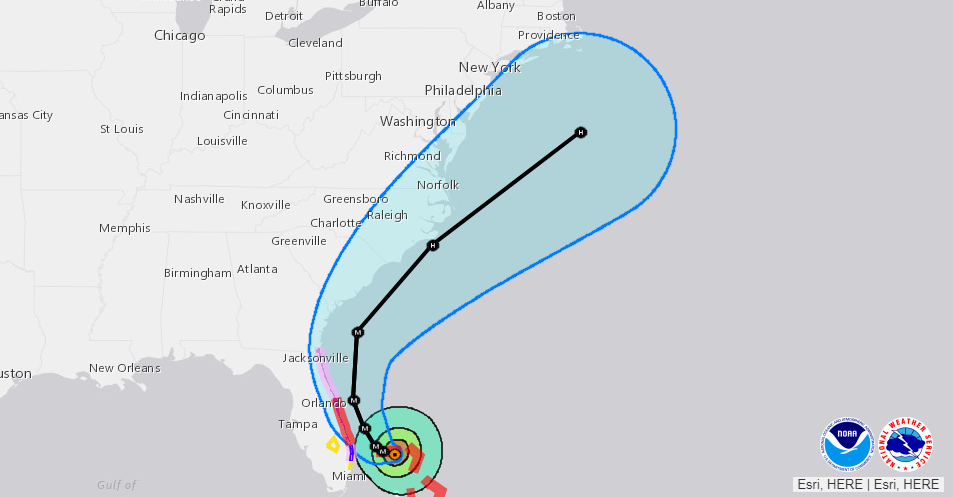

Hurricane Dorian's path has changed slightly but could still make landfall in Florida (Credit: NOAA)

AM Best has called on insurers with exposure in areas of the US likely to be hit by Hurricane Dorian to submit a breakdown of their expected losses.

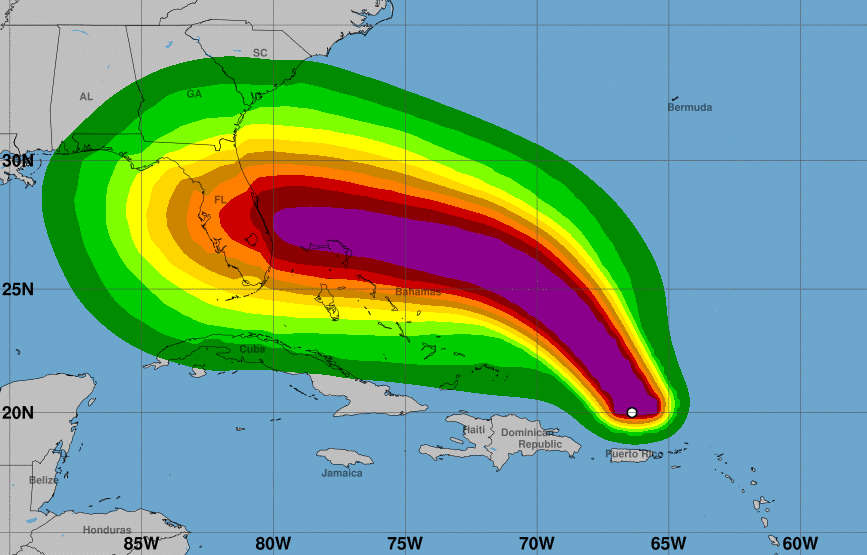

The tropical storm’s path has adjusted since last week, with predictions maintaining a significant chance it could make landfall in Florida over today and tomorrow, but some sources claim this could happen on the coast of North and South Carolina instead.

AM Best’s report said there’s too much uncertainty to estimate the financial impact to the insurance market at this time, but expects insurers to report their expected losses so it can factor them into its next rating.

The report said: “All of the AM Best-rated entities are expected to provide preliminary estimates and/or ranges of their potential losses in a reasonable time frame although company loss estimates will take time to determine.

“These loss estimates will be expected to include any potential effects and take into account the involvement of any government-specific ‘wind’ and ‘beach’ residual market mechanisms when applicable.

“Principal among these are the National Flood Insurance Program (NFIP), which is responsible for almost all residential flood coverage in the country, and the Florida Hurricane Catastrophe Fund (FHCF), which provides reinsurance coverage for Florida residential property writers.”

How much damage is Dorian expected to cause in Florida?

The National Hurricane Center released an update this morning that Dorian — now a category 5 storm — would move “dangerously close” to Florida’s East Coast tonight through to Wednesday evening.

AM Best’s report said it is currently too early to tell what impact Dorian will have on Florida’s personal lines segment, but expects home and auto losses to be

substantial — particularly if the storm moves across central and southern Florida.

It also said the commercial insurance segment is likely to experience significant claims for both direct property losses and business interruption — particularly if Dorian continues to move at a relatively slow pace.

AM Best believes smaller, Florida-only property insurers not rated by AM Best are significantly exposed to losses, due to a lack of geographical diversification in their risk profile.

How prepared is Florida’s insurance market for Hurricane Dorian impact?

AM Best expects its ratings will remain favourable for those with risk exposure in Florida, based on stress tests it conducted on modelled catastrophe losses.

But for companies it rates with a high concentration of business in the state, the impact could be felt much harder and their rating will largely depend on reinsurance agreements provided by the FHCF and the private market.

For reinsurance companies, AM Best expects Dorian to be an earnings event — meaning the claims will only eat into their profits, leaving the capital of third-party investors safe.

It said: “AM Best expects Dorian alone to be more of an earnings event, as balance sheets are extremely strong and have been stress-tested sufficiently to absorb extreme losses.

“Dorian may make the case for continued price increases, but it may be premature to come to this conclusion until losses are tallied and any other events for the remainder of the year are considered.”